The financial benefit of a New York rebate or in real estate referred to a commission rebate are comparatively new. Even though brokers have been incentivizing and rewarding buyers with a New York rebate since 2015, many still believe that it is too good to be true. While others choose not to promote this cash back savings, learn how working with the Real Estate rebate team can help you reap in the benefits and save on your dream home today.

What is a New York Rebate?

Simply put, it is a refund a buyer’s agent pays the buyer at closing cost. A New York rebate is a portion of the commission the real estate agent receives that is given back to the buyer. Once you search and find your dream home, the Real Estate rebate team makes the offer, negotiates your price and gives you cash back at closing.

How does New York Rebate work?

New York rebate or sometimes referred to as a commission refund is essentially getting money back from the buyer’s broker at closing. This significant savings is passed on to the buyer by putting money back in their pocket to be used for other expenses like closing cost, home improvement or home furnishings. This allows the buyer to search for their dream home at their leisure and when it’s time to make the offer, the Real Estate rebate team will help negotiate and get you to the closing table with a rebate check ready in hand.

Here is an example of how New York rebates work.

In New York, the seller usually pays 6% commission of the sale price to their broker. The buyer’s broker will receive half of the total commission of 3%. Each half will then be divided between the real estate brokerage and the licensed real estate agent. With the Real Estate rebate team, we take our 3% commission and pass back the savings to you giving you a cash rebate at the closing table.

How much can a buyer really save with a New York Rebate?

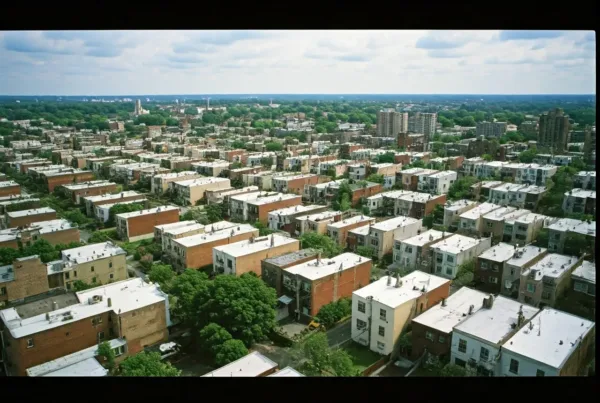

A buyer can save with a New York rebate depending on the purchase price of the property and negotiated commission. On average the commission rebate in New York ranges around 6% (or 3% split). Here is an example based on a $3,000,000 home.

The seller and the buyer’s agent commission (6% of purchase price) comes out to be $90,000 each (3% to each broker agent) with a commission rebate of up to $45,000 back to the buyer. Contact the Real Estate rebate team to see your potential New York rebate today.

Are New York Rebates Taxable?

New York rebates are considered tax-free however, we strongly advise buyers to speak with their tax accountant for all tax related advice and guidance to understand the tax obligation on the New York rebate commission refund.

Are New York Rebates Legal?

Absolutely. New York rebate commission refunds are legal and can lower buyer’s transaction costs and increase competition among real estate agents. In 2015, even the New York Attorney General highlighted the consumer benefits of New York rebate commissions as another way to embrace the competitive opportunity and improve choices available to homeowners and buyers. New York rebates are legal in New York state, New York City, New Jersey State and Connecticut state.

What if a buyer works with a different agent or broker?

New York rebate commissions are negotiated with the buyer and not the seller. Not all brokerage firms offer a New York rebate so if you decide to work with another agent or brokerage, they may not be willing to give up part of their commission.

It’s best to partner with a team that offers the commission rebate in full transparency like the Real Estate rebate team. Once the buyer is ready to make an offer on their dream home, the Real Estate rebate team will provide you with the industry expertise to negotiate your price, guide you through the process and at closing provide you with a cash rebate in hand.