Discover the hidden perks of buyer broker rewards that can save you money and make your home buying experience seamless.

Table of Contents

Introduction: Understanding Buyer Broker Rewards

In the world of real estate, there exists a concept known as buyer broker compensation. This compensation, also referred to as buyer broker rewards, plays a crucial role in property transactions. In this section, we will delve into the essence of buyer broker rewards and explore their significance in the realm of real estate.

What Are Buyer Broker Rewards?

Buyer broker rewards encompass the incentives or benefits that a buyer’s broker receives for their services in helping individuals find and purchase a property. These rewards can come in various forms, such as commission rebates or discounts on real estate services.

Types of Rewards in Real Estate

real estate agents may receive different types of rewards or incentives for their services. These can include commission rebates, bonuses, or discounts on commission fees. Understanding these rewards is essential for both buyers and agents to navigate the real estate market effectively.

The Basics of Commission in Real Estate

In real estate, when a property is bought or sold, the agents involved in the transaction receive a payment called a commission. This commission is typically a percentage of the final sale price of the property. For example, if a house is sold for $300,000 and the commission rate is 6%, the agents would receive $18,000 as their commission.

Real Estate Agent Incentives

Real estate agents work hard to help buyers find their dream homes and assist sellers in selling their properties. To motivate agents and reward their efforts, different types of incentives are offered. One common incentive is a commission rebate, where a portion of the commission earned by the agent is given back to the buyer as a discount on the property price.

What Is a Commission Rebate?

When you buy a house, you usually work with a real estate agent to help you find the perfect home. This agent helps you navigate the process and ensures that everything goes smoothly. But did you know that sometimes, these agents can offer you something called a commission rebate?

Image courtesy of therealestatetrainer.com via Google Images

Definition of Commission Rebate

A commission rebate is when your real estate agent gives you back a portion of the commission they receive for helping you buy a house. In places like New York City (NYC), commission rebates are quite common. This means that after you close on your new home, your agent may give you some money back as a reward for choosing to work with them.

How Commission Rebates Work

Imagine you buy a house for $300,000, and the seller agrees to pay a 6% commission to be split between the buyer’s agent and the seller’s agent. This means the total commission would be $18,000. If your agent offers you a 50% commission rebate, you could get $9,000 back as a rebate after closing on the house.

The Impact of Buyer Broker Rewards

This section will look at the influence of buyer broker rewards on the industry and on the decisions of buyers and agents.

Benefits to Buyers

Buyer broker rewards, such as real estate discount commissions and commission rebates, can have a significant impact on buyers looking to purchase a home. These rewards can make the overall cost of buying a property more affordable for buyers, allowing them to save money on their purchase.

For example, a real estate agent offering a commission rebate may give a portion of their commission back to the buyer as an incentive for using their services. This rebate can help offset some of the costs associated with buying a home, such as closing costs or moving expenses.

By receiving these rewards, buyers can stretch their budget further, potentially allowing them to afford a more expensive property or to have extra funds for renovations or upgrades.

Effects on Real Estate Agents

Offering buyer broker rewards can also have a significant impact on real estate agents. In a competitive market, agents may use rewards such as commission rebates as a way to attract more clients and stand out from their competitors.

| Buyer Broker Rewards | Benefits |

|---|---|

| Increased Commission | Buyer brokers often receive higher commissions for bringing in qualified buyers. |

| Access to Exclusive Listings | Buyer brokers may gain access to exclusive listings before they hit the market. |

| Market Insights | Buyer brokers have access to market insights and trends to help clients make informed decisions. |

| Negotiation Skills | Buyer brokers can negotiate on behalf of clients to secure the best deal possible. |

| Guidance and Support | Buyer brokers provide guidance and support throughout the entire buying process. |

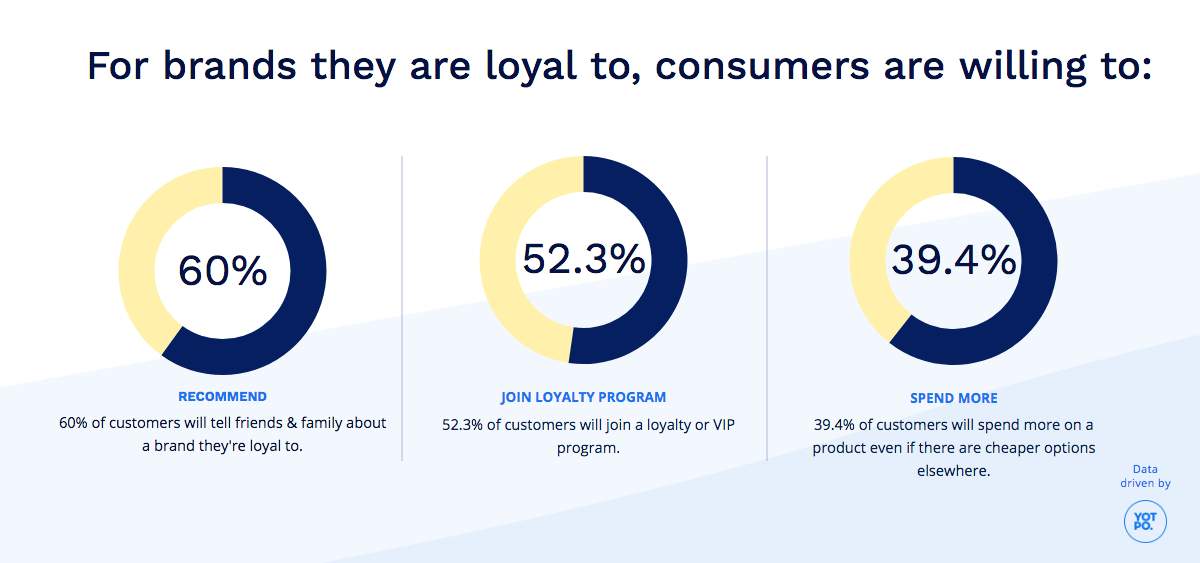

By offering incentives and rewards, agents can build a loyal client base and secure more business. This can lead to increased referrals and positive word-of-mouth, further boosting their reputation in the industry.

However, agents must carefully consider the impact of offering rewards on their bottom line. While rewards can attract more clients, they also reduce the agent’s overall earnings. Agents must strike a balance between offering incentives and maintaining a profitable business.

Are Commission Rebates Taxable?

Commission rebates are a topic of interest for many buyers in the real estate market. When you receive a commission rebate from your broker, it’s important to understand the tax implications that come along with it. Let’s delve into whether commission rebates are taxable and what buyers should keep in mind.

Image courtesy of affise.com via Google Images

Understanding the Tax Perspective

When it comes to commission rebates, the general consensus is that they are not considered taxable income for buyers. This means that you typically won’t have to report the rebate as income on your tax return. The rebate is seen as a reduction in the purchase price of your property, rather than additional income.

However, it’s essential to consult with a tax professional or accountant to ensure that you are compliant with any specific tax laws in your area. Tax regulations can vary from state to state, so it’s always wise to seek professional advice to avoid any surprises come tax season.

Tax Tips for Buyers

As you navigate the process of buying a home and potentially receiving a commission rebate, here are a few simple tax tips to keep in mind:

1. Keep Records: Make sure to keep detailed records of any commission rebates you receive. This documentation will come in handy if you ever need to provide proof of the rebate when filing your taxes.

2. Consult a Professional: When in doubt, seek the guidance of a tax professional. They can provide personalized advice based on your unique situation and ensure that you are following all tax laws correctly.

3. Stay Informed: Tax laws and regulations can change, so it’s crucial to stay informed about any updates that may impact the tax treatment of commission rebates in real estate transactions.

Conclusion: Making Informed Decisions

Throughout this blog post, we have delved into the world of buyer broker rewards, commission rebates, and the impact they have on real estate transactions. By understanding these concepts, buyers and agents can make informed decisions that benefit them in the long run.

Key Takeaways:

1. Buyer broker rewards, including commission rebates, play a vital role in real estate transactions by offering incentives to both buyers and agents.

2. Understanding how commission works in real estate and the different types of rewards available can help buyers navigate the home buying process more effectively.

3. Commission rebates can provide financial relief to buyers, making homeownership more affordable and accessible.

4. Real estate agents can improve their competitiveness in the market by offering attractive rewards and incentives to potential buyers.

Importance of Informed Decision-Making:

When it comes to buying a home or engaging in real estate transactions, knowledge is power. By being informed about buyer broker rewards, commission rebates, and their impact, buyers can make smarter decisions that align with their financial goals and preferences.

It is crucial for both buyers and agents to have a clear understanding of how rewards work and the potential benefits they can provide. This knowledge empowers individuals to negotiate effectively, choose the right agents, and ultimately, achieve successful outcomes in their real estate endeavors.

By staying informed, asking the right questions, and seeking guidance from professionals, buyers can navigate the complexities of the real estate market with confidence and clarity. Making informed decisions is key to a satisfying and rewarding real estate experience.

Frequently Asked Questions (FAQs)

What is buyer broker compensation?

Buyer broker compensation refers to the payment received by a real estate agent for their services in helping a buyer purchase a property. This compensation can come in the form of a commission, which is typically a percentage of the final sale price of the property.

How do I get a commission rebate in NYC?

To receive a commission rebate in NYC, you would need to work with a real estate agent who offers this incentive. A commission rebate is when a portion of the commission earned by the buyer’s agent is given back to the buyer as a discount or cash rebate after the property purchase is finalized.

Are commission rebates considered taxable income?

Begin your search and start earning cash back!

Commission rebates are generally not considered taxable income for buyers. The rebate is a repayment of a portion of the commission that the buyer’s agent receives from the seller, and it is typically treated as a reduction in the purchase price of the property. However, it’s advisable to consult with a tax professional for specific advice regarding your individual circumstances.