Discover the unexpected truth about realtor rebates and whether or not you could be facing unexpected tax consequences.

Table of Contents

Introduction: What’s the Deal with Realtor Rebates?

Hey there! Have you ever heard about something called realtor rebates? Well, when you buy a home, sometimes your real estate agent might give you back some money, and that’s what we’re going to chat about today. Let’s find out if you need to pay taxes on these rebates. Exciting, right?

Understanding Realtor Rebates

Realtor rebates are a cool way to save money when you buy a house. Imagine getting some cash back after making such a big purchase! Let’s dive into what realtor rebates are all about and why realtors give them.

What Are Realtor Rebates?

Realtor rebates are like a little gift from your real estate agent. When they sell a house, they usually get paid a chunk of money called a commission. Sometimes, they share a bit of that commission with you as a rebate. It’s like a bonus for choosing them to help you find your dream home.

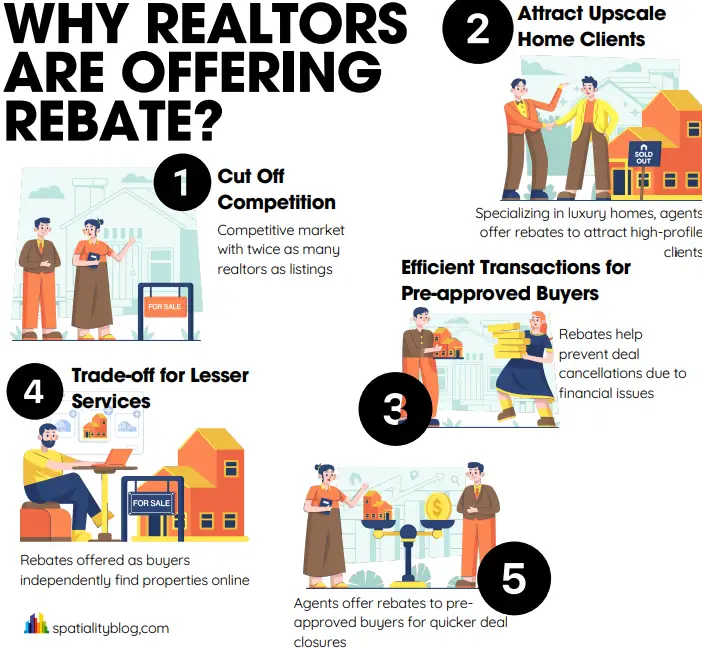

Why Do Realtors Give Rebates?

Realtors give rebates to stand out from the crowd. Just like how you might get excited about a toy that comes with a free gift, realtors want to attract buyers by offering them something extra. It’s their way of saying, “Thanks for picking me to be your guide in the home-buying adventure!”

Are Commission Rebates Taxable?

When you hear about getting money back from buying a house, you might wonder if you need to pay taxes on that extra cash. Let’s take a closer look at whether the government sees these commission rebates as taxable income.

Image courtesy of spatialityblog.com via Google Images

What the Tax Rules Say

Simply put, tax rules are like guidelines set by the government to decide how much money people have to pay from what they earn. In the case of commission rebates, the government may consider this money as taxable income.

So, if you receive a rebate from your real estate agent after purchasing a home, it’s crucial to be aware that you may need to report this amount on your tax return and possibly pay taxes on it. Keeping track of any rebate transactions and seeking advice from a tax professional can help you navigate the process smoothly.

Real Life Examples

Let’s imagine a family, the Smiths, who recently purchased their first home with the help of a real estate agent. After the sale went through, the realtor gives them a rebate as a thank you for choosing to work with them. The Smiths are excited about this unexpected bonus and start thinking about what they could use the money for.

Now, here comes the big question: should the Smiths pay taxes on the rebate they received? It’s essential for them to know whether this additional money is taxable or not. Understanding the rules regarding real estate commission refunds is crucial in making informed financial decisions.

What To Do With Your Realtor Rebates

Receiving a realtor rebate can be exciting, but it’s also important to understand what to do with the money you get back. Here are some tips on how to handle your realtor rebates responsibly:

| Question | Answer |

|---|---|

| Are Realtor Rebates Taxable? | Yes, realtor rebates are considered taxable income by the IRS. |

| How are Realtor Rebates Taxed? | Realtor rebates are usually treated as ordinary income and are subject to federal income tax. |

| Is there an Exception? | There may be certain exceptions or exclusions for realtor rebates if they meet specific criteria set by the IRS. It’s recommended to consult with a tax professional for more information. |

Image courtesy of www.linkedin.com via Google Images

Keeping Records

When you receive a rebate from your realtor, make sure to keep all the paperwork and documentation related to it safe. Just like when you receive a gift and want to remember who it was from, keeping records of your realtor rebate will help you in case you need to refer back to it for any reason.

Asking the Experts

If you’re unsure about what to do with your realtor rebate or if you have any questions about taxes, it’s always a good idea to ask someone who knows a lot about money. You can consider consulting a tax professional who can provide you with guidance on how to handle the money you received back from your realtor.

Conclusion: Summing It Up

So, now you know all about realtor rebates and whether they are taxable. Realtor rebates are like a thank-you from your real estate agent for choosing them to help you buy a house. They give you some of the money they make as a refund. But the big question is, do you have to pay taxes on that money?

Well, the good news is that in most cases, these rebates are not taxable. That means you get to keep all of the money without giving a portion to the government. It’s like getting a little bonus for buying a house!

Remember, it’s always a smart idea to keep records of any money you receive, including rebates. Just like when you get a gift and want to remember who gave it to you, keeping track of your rebates can help you stay organized.

If you ever have any questions about your rebate or taxes, don’t hesitate to ask someone who knows a lot about money, like a tax expert. They can help guide you and make sure you’re following all the rules.

Now that you understand the ins and outs of realtor rebates and taxes, you’re ready to make informed decisions when it comes to buying a home. Happy house hunting!

Frequently Asked Questions (FAQs)

Do I always get a rebate when I buy a house?

Rebates aren’t always guaranteed when you buy a house. It depends on the realtor you work with and if they offer rebates as part of their services.

Can I use the rebate for anything?

Once you receive a rebate, you can typically use it however you want. Some people choose to put it towards their new home, while others might decide to save or invest it for the future.

Who should I ask if I have questions about my rebate and taxes?

Begin your search and start earning cash back!

If you have any questions about your rebate and whether or not it is taxable, it’s a good idea to talk to a parent, guardian, or a tax professional. They can help you understand the rules and what steps you need to take.