Uncover the hidden costs of new builds and why paying more might not always be the best option for buyers.

Table of Contents

- Introduction: Understanding Taxes and New Condos

- The Allure of New Condos: Why People Buy Them

- The High Price of Fresh Foundations: Taxes on New Constructions

- New York, New Builds: Tax Implications in the Big Apple

- Making an Informed Decision: Should You Buy a New Condo?

- Conclusion: Balancing Cost and Comfort

- FAQs

Introduction: Understanding Taxes and New Condos

Have you ever wondered why taxes might be higher on new buildings, especially new condos in New York? Let’s explore this topic and uncover the reasons behind the tax nuances in new construction projects.

When it comes to buying a new condo, understanding the tax implications is crucial. By delving into why taxes are higher on new constructions, especially in a vibrant city like New York, we can gain valuable insights into the cost factors involved.

The Allure of New Condos: Why People Buy Them

People are drawn to new condos because they come with all the latest features and amenities. Imagine walking into a brand-new condo with shiny appliances, sleek countertops, and modern design elements. These new condos are equipped with state-of-the-art technology, energy-efficient appliances, and contemporary styling that appeal to buyers looking for a comfortable and convenient living space.

Location and Lifestyle

One of the main reasons why people choose to buy new condos, especially in places like New York City, is the prime locations they offer. new construction condos are often built in trendy neighborhoods with easy access to amenities, restaurants, shops, and public transportation. This convenient lifestyle is a major draw for many buyers who want to be in the heart of a bustling city like NYC.

The High Price of Fresh Foundations: Taxes on New Constructions

When it comes to new constructions, one important factor that potential buyers need to consider is the impact of taxes. Let’s delve into why taxes on new builds tend to be higher, especially when it comes to the cost of building a condo.

Image courtesy of www.reddit.com via Google Images

Assessment of Property Value

One reason why taxes on new constructions are higher is due to how property values are assessed. When a new condo is built, it is typically valued at a higher price compared to older properties. This higher valuation leads to increased property taxes, as taxes are calculated based on the assessed value of the property.

Development and Infrastructure

In addition to property taxes, new constructions may also incur additional taxes to fund local infrastructure improvements and developments. These taxes are often necessary to support the growing needs of communities where new builds are taking place. While these taxes contribute to the overall cost of owning a new condo, they also benefit residents by improving the quality of infrastructure in the area.

New York, New Builds: Tax Implications in the Big Apple

When it comes to new constructions in Manhattan and New York City, there are specific tax implications that potential buyers need to be aware of. Understanding how taxes work in these areas can help individuals make informed decisions when considering purchasing a new condo.

Local Tax Policies

In New York City, taxes on new constructions can be influenced by various local tax policies. These policies may differ from other locations and can impact the overall tax rates for new builds. It’s essential for buyers to familiarize themselves with the specific tax regulations in Manhattan and NYC to accurately assess the tax implications of purchasing a new construction property.

Tax Abatements and Incentives

Despite the potential for higher taxes on new constructions, there may be tax abatements and incentives available to buyers. These programs can help offset some of the tax burdens associated with purchasing a new condo in NYC. It’s crucial for buyers to research and take advantage of any tax incentives that may apply to their particular situation to make the most cost-effective decision.

Making an Informed Decision: Should You Buy a New Condo?

When deciding whether to buy a new condo, it’s essential to weigh the advantages and disadvantages carefully. One major perk of purchasing a new construction condo is that everything is brand new! From appliances to fixtures, you won’t have to worry about wear and tear for a while. Additionally, new condos often come with modern features and amenities that can make your living experience more comfortable and convenient.

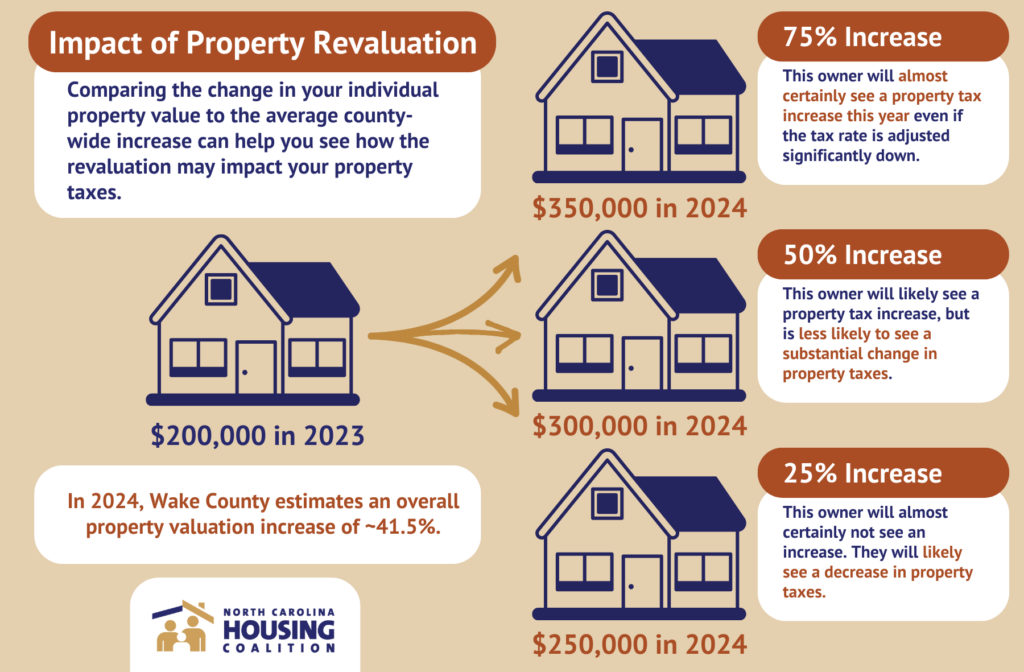

Image courtesy of nchousing.org via Google Images

However, there are some downsides to consider as well. New construction condos tend to come with a higher price tag compared to older properties. This means not only a higher upfront cost but also potentially higher property taxes. It’s crucial to factor in all expenses, including taxes, when determining if a new condo is within your budget.

Calculating Long-Term Costs

One way to make an informed decision about buying a new condo is to calculate the long-term costs involved. In addition to the purchase price, you’ll need to consider ongoing expenses like maintenance fees, utilities, and property taxes. When it comes to taxes, new constructions are often assessed at a higher value, leading to higher tax bills.

| Tax Nuances | Details |

|---|---|

| 1. Property Tax | New builds may have higher property taxes due to assessed value being based on the market value of the property. |

| 2. Sales Tax | Some states may charge sales tax on newly constructed homes, adding to the overall cost. |

| 3. Tax Credits | Homeowners in new builds may be eligible for tax credits for energy-efficient upgrades or renewable energy installations. |

| 4. Capital Gains Tax | If you sell your new build for a profit, you may be subject to capital gains tax on the earnings. |

It’s important to look beyond the initial excitement of a new condo and consider the financial implications over the long term. Make sure to factor in potential increases in property taxes over the years and how they may impact your overall budget. By taking a comprehensive look at the costs involved, you can determine if buying a new condo aligns with your financial goals.

Conclusion: Balancing Cost and Comfort

After delving into the nuances of taxes on new constructions, especially new condos in places like New York, it’s essential to consider how to balance the cost implications with the comfort and appeal these properties offer. While taxes may be higher on new construction, there are various factors to weigh before making a decision on whether to buy a new condo.

Reflecting on Tax Impact

Understanding why taxes are higher on new construction is crucial in making an informed decision. The increased property value assessment for new condos plays a significant role in the higher taxes. Additionally, taxes levied for development and infrastructure improvements contribute to the overall tax burden on new constructions. By considering these factors, buyers can better comprehend the tax implications of purchasing a new condo.

Considering Comfort and Appeal

Despite the financial aspects, the allure of new condos cannot be overlooked. From modern features and amenities to prime locations offering a desirable lifestyle, new constructions provide a level of comfort and luxury that may outweigh the higher tax rates. The decision to buy a new condo should factor in these benefits to achieve a balance between cost and comfort.

Striking a Balance

Ultimately, the choice to buy a new condo comes down to finding the right equilibrium between cost and comfort. While taxes may be a consideration, the advantages of modern amenities, prime locations, and potential long-term investment returns should also be factored into the decision-making process. By carefully evaluating the pros and cons and calculating the long-term costs, buyers can make a well-informed choice that aligns with their financial goals and lifestyle preferences.

FAQs

Why might someone choose a new condo despite higher taxes?

People may choose to buy a new condo despite higher taxes because new condos often come with modern features and amenities that older properties may not have. These new constructions also tend to be located in desirable areas with convenient access to facilities and services. Additionally, buying a new condo can offer a sense of security knowing that everything is in top-notch condition and meets current building codes.

Are there ways to decrease the tax burden on new construction condos?

There are some strategies that may help decrease the tax burden on new construction condos. One way is to explore any available tax abatements or incentives that may be offered by the local government. These programs can sometimes provide temporary relief from property taxes, making the financial burden more manageable. It is also advisable to consult with a tax professional or real estate agent to explore all available options for reducing taxes on a new construction property.

How are property taxes calculated for new condo constructions in NYC?

Property taxes for new condo constructions in NYC are typically calculated based on the assessed value of the property. The assessed value is determined by the city’s Department of Finance and is used to calculate the amount of property tax owed. New constructions may be assessed at a higher value compared to older properties due to factors such as the cost of building a condo and the potential for increased property value in newer developments.

What are tax abatements and how do they work?

Tax abatements are programs offered by the government to reduce or defer property taxes for a certain period of time. These incentives are often aimed at encouraging development in specific areas or promoting certain types of properties, such as new construction condos. Tax abatements work by providing a temporary reduction in property taxes, which can help offset the higher tax burden that may come with buying a new construction property. It’s essential to understand the terms and conditions of any tax abatement program to fully assess the benefits it offers.

Begin your search and start earning cash back!

Generated by Texta.ai Blog Automation