Uncover the mystery behind NYC’s new broker fees law – what it means for renters and landlords alike. Don’t miss out!

Table of Contents

Introduction: What’s the Buzz About Broker Fees in NYC?

We all know how exciting it can be to find a new place to live, especially in a bustling city like New York City. But have you ever heard about the mysterious world of broker fees? They’re the talk of the town when it comes to renting apartments in NYC.

When searching for a new home in the Big Apple, one big question that often comes up is: What are these broker fees all about? Well, get ready to unravel the mystery as we dive into the world of NYC broker fees and why they have everyone buzzing!

Understanding Broker Fees

In New York City, when you’re looking for a new place to live, you might come across something called broker fees. But what are broker fees? Let’s break it down in a way that’s easy to understand.

Broker fees are extra charges

Broker fees are extra charges that apartment seekers may have to pay when they rent a new place. These fees go to the real estate broker who helped them find the apartment. Think of brokers as matchmakers between renters and landlords.

In New York City, these fees can significantly impact your rental budget. Typically, broker fees amount to 10 to 15 percent of the first year’s rent. For example, if you’re renting an apartment with a monthly cost of $3,000, your annual rent totals $36,000. Thus, you should anticipate paying anywhere from $3,600 to $5,400 in brokerage fees. This is in addition to your first month’s rent and any security deposit required.

Understanding these costs upfront helps you plan your finances better and avoid any surprises when you find that perfect apartment. So, when budgeting for your next rental, remember to factor in these potential fees to get a clearer picture of your total rental costs.

1. How do broker fees impact the total upfront cost when renting an apartment?

Broker fees add a significant cost on top of the initial month’s rent, increasing the amount of money renters need upfront.

2. What is the potential range of broker fees for a specific rent amount?

For an apartment with an annual rent of $36,000, the fees could range from approximately $3,600 to $5,400.

3. How are broker fees calculated?

Broker fees are generally a percentage of the first year’s rent, usually ranging between 10 to 15 percent.

Historical Snippet

Long ago, when people needed help finding an apartment in the big city, they would turn to real estate brokers. Brokers would show them different places and help them with the rental process. As a thank you for their hard work, renters started paying these brokers a fee.

Do All Renters Pay These Fees?

Not every renter in NYC has to pay broker fees. Sometimes, landlords may cover these fees to attract more tenants. It’s essential to check your rental agreement to see who is responsible for paying the broker fees.

Understanding why some rentals in New York City come without broker fees requires a look at the local market conditions:

- Market Dynamics: When the inventory of available apartments is low and competition among potential renters is high, brokerage fees typically increase. In such scenarios, fees can exceed the normal range, at times reaching up to 20%.

- Renter’s Market: Conversely, when there is an abundance of available apartments, landlords and management companies often face pressure to fill vacancies. In these cases, broker fees might be waived altogether as they shift the cost burden from renters to themselves.

- Shifting Responsibilities: Even when renters aren’t directly paying these fees, brokers and agents are still compensated for their work. The payment responsibility simply moves to the landlords or management companies.

In summary, whether or not you have to pay a broker fee in NYC largely depends on current market conditions and who is motivated to cover these costs. Always review your rental agreement to understand your financial obligations fully.

1. Who pays the broker fees when they are not paid by renters?

In situations where renters are not responsible for broker fees, landlords and management companies typically absorb these costs to attract tenants.

2. When do broker fees disappear entirely?

Broker fees may vanish when there is an abundance of apartments and landlords are keen to secure tenants quickly, making it unnecessary for renters to cover these costs.

3. Under what conditions might broker fees exceed the normal range?

Broker fees can exceed the usual 10 to 15 percent range during times of low inventory and heightened competition, as seen in certain periods where some brokers charge significantly more.

4. Why do broker fees increase in certain situations?

Broker fees tend to rise when there is a scarcity of available units and competition among renters is high. This market pressure can lead to increased fees as brokers capitalize on the demand.

Why Do Broker Fees Apply to Rentals in New York City but Not in Other Cities Like Boston?

In the world of real estate, broker fees are a common feature, but their application varies significantly by region. Particularly, New York City stands out as a unique market where broker fees apply to rentals, unlike in Boston and many other places. But why is this the case? Let’s delve deeper.

The New York City Market

New York City’s real estate is distinct due to its high demand and competitive nature. Brokers play a crucial role here, not just in selling properties but in renting them as well. This stems from a combination of factors:

- High Competition: NYC’s dense population and continuous influx of people create an intensely competitive rental market. Brokers help navigate this by providing access to exclusive listings and streamlining the process for prospective tenants.

- Exclusive Listings: Many New York landlords enlist brokers to handle rental processes exclusively, putting them in charge of finding suitable tenants while tenants rely on brokers for access to these elusive options.

- Professional Insight: Given the city’s complex real estate landscape, brokers offer valuable insights and negotiation skills that can be indispensable for renters. Their expertise can significantly aid in securing desirable accommodations.

The Boston Difference

Boston, by contrast, typically sees broker fees applied in a different context. Here, these fees are more commonly associated with property sales rather than rentals. This difference can be attributed to:

- Rental Practices: Boston’s rental market, while competitive, operates differently. Many landlords prefer handling rental processes directly or through property management companies without requiring tenant-paid broker fees.

- Regulatory Environment: Local real estate regulations can influence how fees are structured and charged. Boston’s practices reflect a different dynamic in legal and traditional approaches to renting.

In summary, broker fees in New York City rentals exist largely because of the city’s unique market conditions and the pivotal role brokers play in facilitating transactions. Meanwhile, cities like Boston manifest different practices due to alternate market dynamics and cultural handling of real estate deals.

The Legality of Broker Fees

In this section, we will explore the rules and regulations surrounding broker fees in New York City. Let’s dive into what’s allowed and what’s not when it comes to these fees.

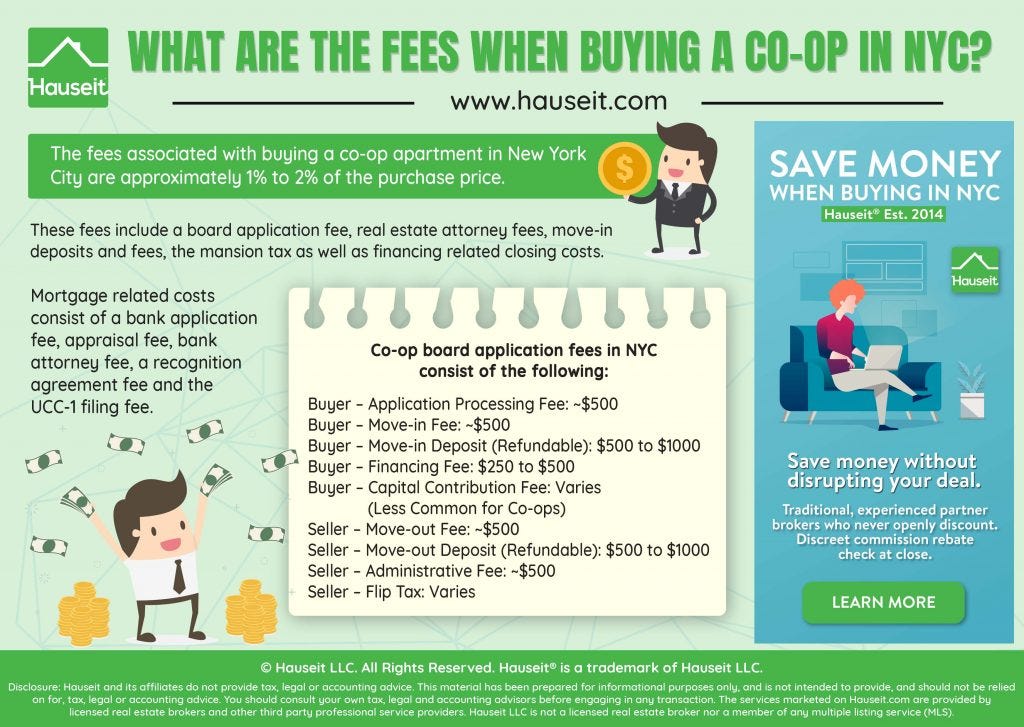

Image courtesy of hauseit.medium.com via Google Images

The Impact of the Temporary Ban on Broker Fees in New York City’s Rental Market

In early 2020, a significant disruption hit the New York City rental market—a temporary prohibition on broker fees for rental properties. This change aimed to alleviate the financial burden on tenants, who traditionally paid these fees in addition to rent and security deposits.

Immediate Effects

- Renters’ Relief: For many prospective tenants, this ban offered immediate financial relief. Without the burden of broker fees, which can often equate to one month’s rent or more, renters found it easier to budget for moving expenses.

- Market Uncertainty: The sudden ban introduced confusion among real estate professionals. Brokers and agents found themselves scrambling to adapt, as their traditional compensation structure faced upheaval. This uncertainty contributed to a more cautious approach among some landlords and agencies.

Legal Challenges and Reversal

Though the ban was short-lived, it faced intense controversy and legal battles that reached the state’s higher courts. The temporary enforcement was lifted within days, leading to a cycle of reinstatement and reversal as legal arguments unfolded.

Long-term Implications

By early 2021, the ability for brokers to charge fees was reinstated, and the market largely returned to its previous state. However, the episode highlighted the potential for regulatory changes to significantly influence market dynamics and pricing strategies. For some renters and real estate professionals alike, it shed light on the ongoing conversation about transparency and fairness in New York City’s rental transactions.

The NYC Broker Fee Law

So, is it legal to charge broker fees in NYC? The answer is yes, but there are specific guidelines that brokers and landlords need to follow. The law states that brokers can charge a fee for their services, but this fee should be paid by either the landlord or the tenant, not both. This means that if you’re renting an apartment and using a broker, you might have to pay a fee, but not both parties.

Recent Changes and Discussions

Some people argue that these fees make it more difficult for renters, especially those with lower incomes, to find affordable housing. As a result, there have been discussions about potentially changing the rules around broker fees to make renting more accessible for everyone.

When inventory is low and competition is fierce, brokerage fees often rise, sometimes exceeding the typical 10 to 15 percent range. For instance, during the summer of 2022 in New York, some brokers were reportedly asking for close to 20 percent. This escalation directly impacts renters, making it even harder to secure housing when demand is high.

On the other hand, in a market with an abundance of available apartments, landlords and management companies may absorb these fees, sometimes eliminating them entirely for renters. In such scenarios, the fees shift from renters to landlords, easing the financial burden for those seeking new homes.

Understanding these dynamics is crucial. Broker fees don’t just affect the cost of renting; they reflect the broader economic conditions of the housing market. By potentially reforming these fees, the aim is to create a more balanced and fair rental landscape, particularly for those most vulnerable to market fluctuations.

1. Are there specific examples of when broker fees have changed due to market conditions?

An example can be seen in New York during the summer of 2022, where broker fees rose significantly due to increased competition and low availability of rental units.

2. Who typically pays the broker fees in different market scenarios?

In a competitive market with limited inventory, renters usually pay the broker fees. However, in a renter’s market with many available units, landlords and management companies often absorb these costs.

3. How do broker fees change in different market conditions?

Broker fees tend to rise when there is low inventory and high competition for rental units. Conversely, when there is an abundance of available apartments, these fees can sometimes be eliminated.

One notable proposal is Assembly Bill A7934A, introduced by State Assemblymember Zohran Mamdani. This bill seeks to prevent landlords, lessors, sub-lessors, and grantors from demanding broker fees from tenants. If passed, it would significantly alter the current landscape of rental transactions.

Additionally, the Fairness in Apartment Rental Expenses (FARE) Act, introduced by City Councilmember Chi Ossé, addresses the financial burden of broker fees. Under this act, only the party who hires the broker—whether it be the landlord to fill a vacancy or the tenant to find an apartment—would be responsible for paying the fee. The FARE Act has sparked a lively debate, with the real estate industry opposing the change. However, it has gained substantial support from several City Council colleagues, including Julie Menin, who has pledged to hold a hearing on the matter.

These legislative efforts reflect a growing movement to address the financial hurdles faced by renters in New York City, aiming to make the rental market fairer and more accessible.

1. What is the geographical focus of the legislative proposals?

The proposals specifically concern District 036 in Queens, represented by Zohran Mamdani.

2. What is the current status or support level of these proposals?

The real estate industry opposes these proposals, but they have gained significant backing from several City Council members. Julie Menin, chair of the council’s Committee on Consumer and Worker Protections, has also pledged to hold a hearing on the matter.

3. What are the specific provisions of these proposals?

Assembly Bill A7934A aims to prevent landlords from charging tenants broker fees. The FARE Act proposes that only the party hiring the broker should be responsible for paying the fee.

4. What specific bills or acts have been proposed?

The specific legislative proposals include Assembly Bill A7934A and the FARE (Fairness in Apartment Rental Expenses) Act.

5. Who is involved in the legislative proposals?

The legislative proposals involve individuals such as State Assemblymember Zohran Mamdani and New York City Councilmember Chi Ossé.

Renters’ Rights and Responsibilities

When you’re renting a place in New York City, you have some important rights. This means there are rules that landlords and brokers have to follow. For example, they can’t ask you for extra money that they didn’t tell you about before.

Who Takes Care of the Fees?

Usually, it’s the person who is renting the apartment that has to pay the broker fees. But sometimes, landlords might decide to cover these costs. It’s essential to know who is responsible for these fees before you sign any papers.

| Category | Explanation |

|---|---|

| What is the NYC Broker Fees Law? | The NYC Broker Fees Law, introduced in 2020, prohibits landlords and rental brokers from charging tenants a broker’s fee. |

| Who is affected by the Law? | Tenants renting apartments in New York City are affected by this law. Landlords and rental brokers are also impacted as they can no longer charge tenants a broker’s fee. |

| Exceptions | There are certain exceptions to the law. For example, if a tenant hires a broker to find an apartment on their behalf, they may still be required to pay the broker’s fee. |

| Enforcement | The NYC Department of State is responsible for enforcing the Broker Fees Law. Tenants who believe they have been charged a broker’s fee in violation of the law can file a complaint with the department. |

How to Find an Apartment Without Paying Broker Fees

Hey there! So, you might be wondering how you can find an awesome apartment in New York City without having to pay those pesky broker fees. Well, I’ve got some cool tips and tricks to share with you!

Image courtesy of hauseit.medium.com via Google Images

Image courtesy of hauseit.medium.com via Google Images

Do-It-Yourself Apartment Hunt

If you don’t want to deal with paying a broker, you can try searching for apartments on your own. This might sound a bit daunting at first, but with a little bit of effort and some online tools, you can definitely find the perfect place for you and your family.

Websites and Apps to Help You Search

There are some amazing websites and apps out there that can make your apartment hunting journey a breeze. Websites like StreetEasy, Zillow, and RentHop are great places to start your search. These platforms allow you to filter your preferences, such as location, price range, and number of bedrooms, making it easier to find exactly what you’re looking for.

Discover Recent No-Fee Rental Listings in New York City

If you’re searching for a no-fee rental in New York City, you’re in luck! Here’s a selection of some of the most recent listings available:

Studios and One-Bedroom Apartments

- East River Lofts, #7F

Situated in East Harlem, this studio offers 1 bath for $3,050 monthly. - No. 3 at Packard Square, #8E

Located in Long Island City, this 1-bedroom, 1-bath apartment is available for $3,806. - South Park Tower, #17G

In the vibrant Lincoln Center neighborhood, find a 1-bedroom, 1-bath rental for $4,300. - James Marquis, #10A

A spacious unit in the Broadway Corridor! This 1-bedroom, 1-bath apartment with 764 square feet is priced at $4,740. - 600 Washington Street, #711

Experience the West Village in this studio with 1 bath, encompassing 426 square feet, for $5,063.

Larger Apartment Options

- Embassy House, #16O

Ideal for families, this Turtle Bay/United Nations residence features 3 bedrooms and 1 bath at $6,250. - The Willoughby, #33E

In Downtown Brooklyn, you’ll find a 2-bedroom, 2-bath apartment having 1,030 square feet, listed at $7,366. - Gateway Plaza Battery Park City, #5E

Set in Battery Park City, enjoy a 3-bedroom, 2-bath home with 1,249 square feet for $9,490. - Anagram Columbus Circle, #19B

This elegant Lincoln Center apartment offers 2 bedrooms and 2 baths for $10,850. - The Pierrepont, #10A

Elegant living in Brooklyn Heights with this spacious 3-bedroom, 2-bath apartment over 1,779 square feet for $14,495.

This diverse range of properties provides ample choices for those seeking comfort and style in the heart of NYC, all without the added stress of broker fees. Whether you’re searching for a cozy studio or a luxurious multi-bedroom apartment, New York City has something just for you!

Conclusion: Quick Recap and Final Thoughts

After diving into the world of NYC broker fees, it’s clear that these fees are a big deal when it comes to renting apartments in the city that never sleeps. We’ve learned about what broker fees are, who usually pays them, and the recent changes to the laws surrounding these fees.

Remember, broker fees are the extra money you might have to pay when you rent an apartment with the help of a broker. These fees can add up, so it’s essential to know your rights and responsibilities as a renter in NYC.

With the recent changes in the law, more people are talking about whether these fees are fair and if there are ways to find an apartment without paying them. It’s all about understanding your options and knowing how to navigate the competitive rental market in the Big Apple.

So, whether you’re looking for a new place or just curious about the buzz around broker fees, knowing the ins and outs of the NYC rental scene can help you make smart decisions when it comes to finding your next home sweet home.

Are Broker Fees Negotiable, and How Can Renters Negotiate These Fees?

Absolutely, broker fees can be negotiated, offering renters a chance to manage their costs. While no laws dictate the exact amount brokers can charge, the fee landscape is flexible. Let’s explore how renters can effectively negotiate these fees:

Understanding the Market

In high-demand rental areas, securing leverage can be challenging, though not impossible. Renters should first assess the local market conditions. If there’s an abundance of available properties, brokers might be more open to negotiating their fees.

Steps to Negotiate Effectively

- Research Standard Fees: Before starting your rental search, investigate typical broker fees in your area. This knowledge will serve as a solid foundation during negotiations.

- Agree Early: From the get-go, discuss the fee expectations openly with the broker. Aim to settle on a percentage or flat fee that both parties find reasonable.

- Leverage Other Offers: If you have found comparable properties with lower fees, use this information as a negotiation tool.

- Payment Structure: Propose alternative payment terms if the total fee is a sticking point. For instance, suggest spreading the payment over several months.

- Highlight Your Position: Demonstrating that you’re a serious and prepared renter can often lead brokers to be more flexible with their fees.

Maintain Transparency

Keeping everything transparent throughout the process reduces the likelihood of misunderstandings. Ensuring that both you and the broker are on the same page prevents unexpected financial surprises when you find the perfect apartment.

By taking these steps, renters can approach the negotiation process with confidence, increasing their chances of securing a fair deal on broker fees.

Work with the Real Estate Rebate Team

Real Estate Rebates Team is a top real estate brokerage firm in NYC and NJ, dedicated to delivering exceptional service and significant savings. Offering up to a 2.5% commission rebate at closing, we pass these savings directly to clients buying or selling homes. Through education and a transparent rebate system, we empower clients to maximize their benefits, with numerous success stories proving our approach. Our online platform allows you to easily calculate potential rebates and find properties that suit your needs. We negotiate the best prices and secure additional incentives at closing, ensuring you get money back whether selling, renting, or buying a condo, co-op, or townhouse. For new developments, we offer even higher rebates on larger commissions. Real Estate Rebates Team helps clients enjoy greater savings and better returns on their real estate transactions.

FAQs: Your Questions Answered

What Are Broker Fees?

Broker fees are additional costs that some people have to pay when they are looking for a new apartment in New York City. These fees are charged by real estate agents, also known as brokers, who help people find a place to live.

Historical Snippet

Broker fees started because brokers provide a service by helping people find apartments in the big city. In the past, before the internet made things easier, it was harder for people to find apartments on their own, so they relied on brokers to help them.

Do All Renters Pay These Fees?

Not all renters have to pay broker fees. Some landlords cover the cost of hiring a broker to help find tenants for their apartments. But in some cases, renters may be asked to pay a fee to the broker for their services.

Begin your search and start earning cash back!

Generated by Texta.ai Blog Automation

Image courtesy of via

Image courtesy of via