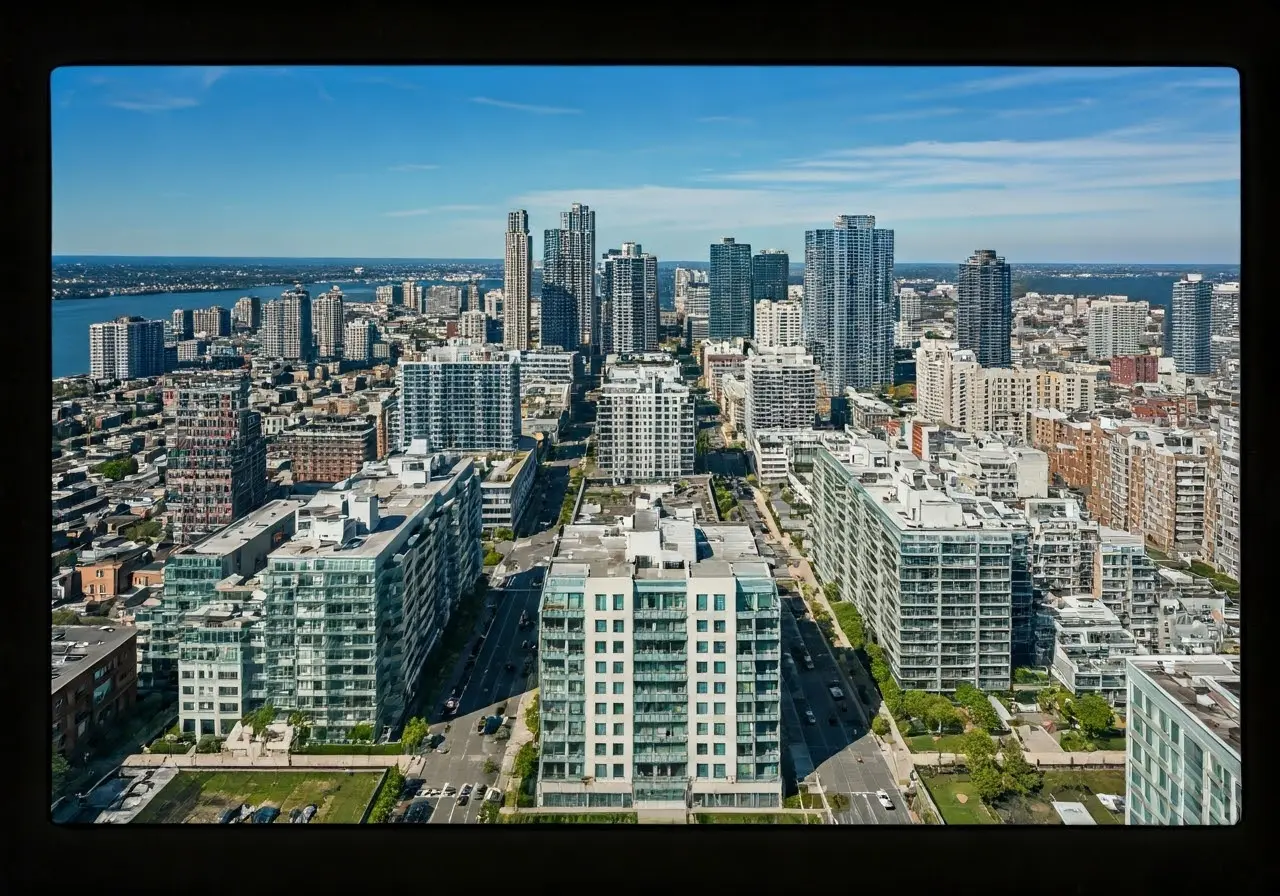

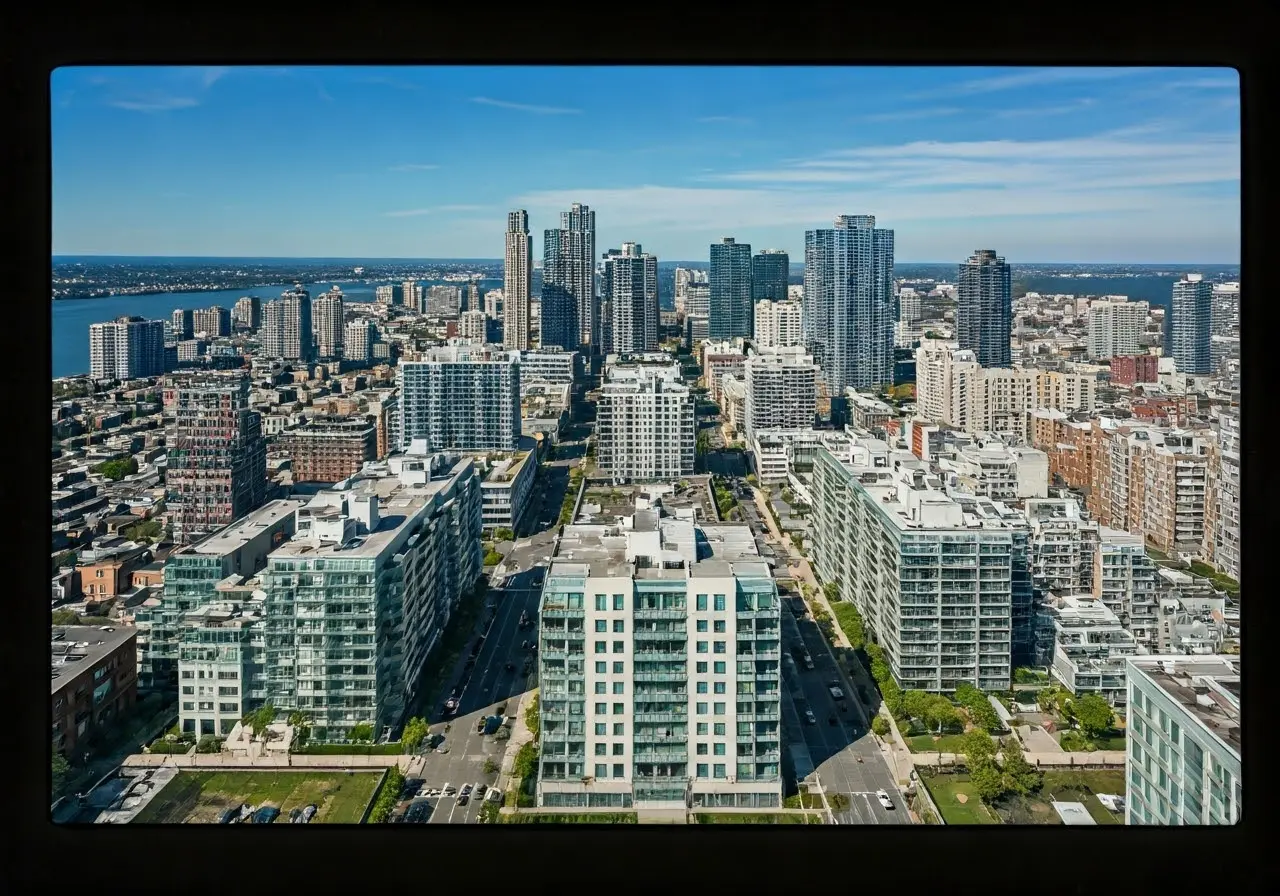

Buying a condo in Long Island City can be a significant investment, but with the right strategies, you can maximize your savings and make the most of your money. In this FAQ blog, we’ll explore some simple steps to help you secure a great deal on your next real estate purchase in this thriving neighborhood.

Research the Local Market

Understanding the current market trends in Long Island City is crucial. Look into recent sales, average price per square foot, and market forecasts to get a sense of what you should be paying. Investigate neighborhoods such as Hunter’s Point and Queensboro Plaza, known for their distinctive charm and housing options. In these areas, prices can vary dramatically based on location, amenities, and proximity to transportation links. What buyers need to know about Long Island City provides insight into Long Island City’s diverse neighborhoods and pricing dynamics.

In addition, explore the potential benefits of different types of housing in Long Island City. While condos often offer more amenities and less maintenance, it’s worth noting that co-ops are generally 10% less expensive than condos and come with rules designed to protect the value of your apartment. Exploring these options can provide clear financial benefits when considering a long-term investment in the area.

Stay informed about new developments and major projects in the pipeline, as these can significantly influence market conditions. The active development scene in Long Island City, including projects like CORE23 and NOVA, can offer a glimpse into future market trends. If you can anticipate shifts in the market, you can position yourself to buy a condo before prices spike, thereby maximizing your savings.

Get Pre-Approved for a Mortgage

Having a mortgage pre-approval gives you a clear idea of your budget and shows sellers you’re a serious buyer, which might give you leverage during negotiations. A pre-approval letter can expedite the buying process, allowing you to make a strong offer quickly once you find your ideal property.

When seeking pre-approval, compare different lenders to find the best interest rates and terms. Lenders assess factors such as your credit score, income, and debt-to-income ratio, so it’s wise to settle any outstanding debts and improve your credit score beforehand. This preparation can help you secure more favorable mortgage terms. Consider consulting with financial advisors for tailored advice to strengthen your loan application.

Consider Off-Peak Buying Times

Purchasing a condo during the off-peak season can often result in significant discounts as sellers may be more willing to negotiate. Typically, markets slow during the winter months, presenting opportunities for buyers who are prepared and flexible with their timing. Seizing this period can align with your financial objectives, allowing you to reduce costs and gain a competitive edge.

Moreover, sellers eager to close before the year’s end are often more likely to offer concessions during this time. Use these conditions to negotiate not just on price, but on other factors such as closing costs and renovation allowances. Thus, planning your purchase strategically during off-peak months might mean substantial savings.

Negotiate Closing Costs

Don’t hesitate to ask the seller to contribute towards closing costs. This can be a substantial saving that you’ll appreciate when finalizing the purchase. Closing costs often include loan origination fees, appraisal fees, insurance, and taxes, all of which can add up quickly.

Working with savvy real estate agents can provide insight into how to negotiate these costs effectively. Real Estate Rebate Team In New York suggests approaching negotiations with a clear understanding of what incentives sellers might be willing to offer. This could include waiving certain fees or even covering the cost of necessary repairs.

Work with an Experienced Local Realtor

A local realtor who knows Long Island City can provide insights into hidden gems and potential savings, as well as guide you through the negotiation process. Realtors with expertise in the area are familiar with the fluctuations in local market conditions and can offer valuable strategic advice.

Engaging with experienced agents enables access to listings before they hit the market and helps in understanding the intricacies of different neighborhoods. They can alert you to potential issues with properties and ensure that you only engage with sellers who are likely to meet your financial requirements.

For those looking to further benefit financially, the Real Estate Rebates Team offers substantial savings through rebate options. Their team ensures that all legal documentation is properly handled, providing an additional layer of security and savings during the buying process.

Make the Most of Your Investment

Maximizing your savings when buying a condo in Long Island City is all about being well-informed and strategic. By following these steps, you’ll be better positioned to make a financially savvy decision that aligns with your goals.