Uncover the truth about broker fees in NYC: Are they legal? What you need to know before renting in the city.

Table of Contents

Hey friends! Have you ever wondered if it’s okay for someone to charge a fee when you’re looking to rent a place in New York City? Well, that’s called a ‘broker fee,’ and we’re going to find out if it’s legal.

What is a Broker Fee?

First, let’s talk about what a broker fee really is. When you’re trying to rent an apartment, sometimes there’s a person who helps you find the right one. Let’s see why they ask for a fee and what it’s for.

The Role of a Broker

Brokers are like helpers who make your apartment search easier. They know the city well and can find places that fit your needs. They show you different apartments and help you with all the paperwork. It’s like having a friend who knows all the best spots in town!

How Broker Fees Work

Let’s learn how these fees are decided and when you have to pay them. When a broker helps you find an apartment, they usually ask for a fee. This fee is typically a percentage of your yearly rent. It’s a way for them to get paid for their time and effort in finding you the perfect place.

Are Broker Fees Legal in NYC?

Now, let’s answer the big question: Is it actually okay for brokers to charge a fee in the Big Apple? We’ll look at the rules to see what’s allowed and what’s not.

Understanding NYC Laws

It’s important to know what the law says about these fees, so you won’t be confused or surprised. In New York City, there are specific laws that govern broker fees. The laws outline what brokers can and cannot do when it comes to charging fees to renters like you. These laws are in place to protect renters and ensure fairness in the rental process.

How the FARE Act Enhances Fairness, Affordability, and Transparency in NYC Rentals

The FARE Act is designed to transform the NYC rental landscape by prioritizing renters’ needs. Here’s how:

- Lower Upfront Costs: One of the main goals of the FARE Act is to reduce the initial financial burden that often comes with signing a lease. By doing so, renters can have more liquidity and flexibility.

- Transparent Fee Structure: The Act mandates clear disclosures of any fees associated with renting. This ensures that tenants know exactly what they are getting into, eliminating the unpleasant surprises of unexpected charges midway through the lease.

- Enhanced Fairness: By leveling the playing field, this legislation strives to create a more equitable environment for both renters and landlords, fostering trust and better relationships.

The FARE Act’s reforms are all about making the rental experience smoother, more predictable, and ultimately, kinder to your wallet.

Timeline for the Implementation of the FARE Act

The FARE Act is set to become active 180 days after being automatically enacted due to the absence of a signature or veto from the Mayor. Assuming there are no interruptions from any ongoing legal actions, we can expect the law to take effect by mid-June 2025.

Here’s a breakdown of the timeline:

- Enactment: The law took effect automatically 30 days after passing the New York City Council.

- Implementation: 180-day countdown begins from the date of enactment, marking the start of the Act’s changes in June 2025.

Until this transition, the current broker fee system in New York City will remain in place. This means that renters may still be required to pay fees to brokers retained by landlords.

Recent Changes to the Law

Sometimes rules change. We’ll check if anything new has happened with the laws about broker fees. It’s essential to stay up to date with any changes in regulations regarding broker fees in NYC. This way, you can make informed decisions when renting an apartment and understand your rights as a renter.

Understanding the FARE Act: A New Era for Broker Fees in NYC

The Fairness in Apartment Rental Expenses (FARE) Act is a transformative piece of legislation reshaping how broker fees are handled in New York City.

Key Changes Introduced by the FARE Act:

- Who Pays the Broker Fees: Traditionally, tenants have been saddled with hefty broker fees when securing a rental. The FARE Act shifts this responsibility to the landlords, who often initiate the hiring of brokers to fill vacancies.

- Transparency in Fees: Landlords or their representatives must clearly disclose any fees associated with rentals in their advertisements and lease agreements. This measure ensures tenants are fully aware of what they might be expected to pay before signing any agreement.

- Optional Tenant Representation: The Act empowers tenants by giving them the option to hire their own brokers for guidance and representation, without being compelled to shoulder the cost of a broker used by a landlord.

- Penalties for Non-Compliance: Landlords who fail to adhere to these regulations could face significant fines and potential legal actions.

In essence, the FARE Act promotes transparency and fairness in the rental process, aligning broker fee responsibilities more closely with the parties who benefit from the broker’s services. This legislative change aims to reduce the financial burden on tenants and introduce clarity and fairness to the rental market.

How Does the FARE Act Affect NYC Renters?

The FARE Act brings significant changes to the renting landscape in New York City by altering how broker fees are handled. Under this new legislation, renters will no longer be obligated to pay a fee to brokers when the brokers are acting on behalf of landlords. This shift eliminates an often unexpected cost from the rental process.

Key Changes:

- Broker Fees: You’ll only pay a broker fee if you personally hire a broker to assist you in finding a home. This means if a broker lists an apartment for a landlord, you aren’t responsible for their fee unless you engage their services.

- Transparent Costs: All fees must be transparently disclosed in advance. This ensures you know precisely what expenses to expect, preventing any unwelcome surprises during the leasing process.

Benefits for Renters:

- Reduced Initial Expenses: By eliminating compulsory broker fees imposed by landlords’ brokers, your upfront costs when signing a lease are significantly reduced.

- Enhanced Clarity and Negotiability: Every fee will be outlined clearly from the start. You’ll have the opportunity to negotiate these fees, providing more control over your rental agreements.

Overall, the FARE Act introduces a more equitable and affordable renting experience, fostering better understanding and fairness in fee structures across the city.

How the FARE Act Will Transform NYC’s Apartment Rental Market

The FARE Act aims to revolutionize the rental landscape in New York City by significantly reducing the financial hurdles that many face when securing an apartment.

Currently, hefty upfront expenses prevent numerous renters from making a move, even if they wish to relocate within the city. Security deposits, advance rent payments, and broker fees can make moving cost-prohibitive. These financial demands often leave potential tenants stuck, unable to take advantage of new housing opportunities.

However, if the FARE Act becomes law, it promises to lower these upfront costs, allowing tenants more freedom to relocate. Easier mobility means more movement in the market, thereby increasing the availability of rental units. This shift could lead to a more dynamic and fluid rental market, providing brokers with more transactions to manage, landlords with a more extensive pool of prospective tenants, and renters with more housing options.

By making moving within the city financially feasible, the FARE Act will not just benefit renters, but the entire real estate ecosystem. It will update how New Yorkers engage with housing, offering an efficient and less costly process for all parties involved.

Potential Benefits of the FARE Act for NYC‘s Housing Market

The FARE Act could significantly transform New York City‘s housing landscape by addressing high upfront costs associated with renting. By reducing these initial financial barriers, the act aims to invigorate the market for renters, brokers, and landlords alike.

Increased Renter Mobility

- Enhanced Mobility: Lower costs empower more renters to move freely within the city, leading to increased availability of rental units.

- Unlocking Inventory: Greater mobility unlocks more rental opportunities, which can alleviate housing shortages and drive a more dynamic market.

Benefits to Brokers and Landlords

- More Transactions: A fluid rental market creates more transactions, thereby increasing business opportunities for brokers and agents.

- Fair Compensation: With more deals in motion, brokers can potentially receive more fair compensation for their services.

Economic Ripple Effect

- Boosting the Economy: As renters move more frequently, ancillary services such as moving companies, furniture stores, and home service providers also experience increased demand.

Overall, the FARE Act is expected to enhance the efficiency and fairness of New York City‘s housing market by making it easier for tens of thousands of potential movers to find the right apartment, while also ensuring that industry professionals are rewarded appropriately for their work.

Benefits of the FARE Act for the Rental Market

The introduction of the FARE Act is poised to bring significant positive changes to the rental market, making it a win-win for tenants, brokers, and landlords.

Removing Financial Obstacles

First and foremost, the act aims to reduce the initial financial demands that often hinder renters from moving within a city like NYC. By easing the upfront costs of securing an apartment, more individuals will have the opportunity to relocate as their needs change, enhancing mobility.

Boosting Renter Mobility

Enhanced flexibility for tenants translates directly into a more dynamic rental market. When tenants can move more freely, it creates a ripple effect that increases the availability of rentals. This, in turn, offers more options for those seeking a new place to live.

Creating More Opportunities for Brokers and Landlords

For brokers, these frequent moves mean more transactions. This uptick in activity not only provides brokers with increased business but also ensures they receive compensation for their services promptly. Landlords benefit from a wider pool of prospective tenants, increasing their chances of finding occupants swiftly and maintaining steady occupancy rates.

Enhancing Market Health

Overall, the FARE Act fosters a healthier rental ecosystem by facilitating smoother transitions and interactions between all parties involved. By lowering the economic barriers that restrict movement, the legislation ensures a fairer playing field and supports sustainable growth across the rental sector.

In summary, the FARE Act sets the stage for a more equitable and efficient housing market by lowering initial costs, enabling greater tenant mobility, and creating more business opportunities for brokers and landlords alike.

How to Negotiate a Broker Fee

So, you’ve found the perfect apartment with the help of a broker, but now you’re faced with a broker fee that you’re not too keen on paying. Don’t worry! There’s a way to negotiate this fee to make it more manageable for you. Let’s dive into some tips on how to do just that.

Image courtesy of www.pinterest.com.mx via Google Images

Tips for Talking to Brokers

When it comes to negotiating a broker fee, communication is key. Here are some tips to keep in mind when talking to brokers:

- Be polite and respectful: Approaching the conversation with a positive attitude can go a long way in getting the broker to consider lowering the fee.

- Do your research: Understand the market rates for broker fees in the area so that you have a good idea of what is reasonable to pay.

- Ask questions: Don’t be afraid to inquire about the breakdown of the fee or if there are any ways to reduce it.

- Offer something in return: Sometimes offering to sign a longer lease or paying the fee upfront can convince the broker to lower the fee.

Understanding Your Power as a Renter

As a renter, you have more power than you may realize when it comes to negotiating a broker fee. Here are some ways you can assert this power:

| Question | Answer |

|---|---|

| Is a Broker Fee Legal in NYC? | Yes, broker fees are legal in New York City. |

| Are there any restrictions on broker fees in NYC? | Yes, there are regulations in place that limit the amount of broker fees that can be charged to tenants. Landlords and rental agents cannot charge more than one month’s rent as a broker fee. |

| What is the typical broker fee in NYC? | The standard broker fee in NYC is usually one month’s rent, but this can vary depending on the specific rental market and location. |

| Are there any exceptions to paying a broker fee? | Some landlords may offer no-fee apartments where they cover the cost of the broker fee, but these can be limited in availability. |

- Know your options: Remember that there are other apartments out there, and you can walk away if the broker fee is non-negotiable.

- Don’t be afraid to negotiate: Brokers are often open to discussions about fees, so don’t hesitate to speak up about your concerns.

- Consider alternate listings: If the broker fee is too high, explore other listings that may not require a fee or have lower fees.

Finding Apartments Without Broker Fees

What if you don’t want to pay a fee at all? Is that possible? Yes, it is! We’ll look at how you can find a place without this extra cost.

No-Fee Apartment Hunting

Did you know that there are apartments out there that don’t have these extra fees? It’s true! These places are called ‘no-fee apartments.‘ Let’s find out how you can discover them.

The Pros and Cons of No-Fee Apartments

Choosing a no-fee apartment sounds pretty cool, but like everything, it has its upsides and downsides. Let’s explore both to see if it’s the right choice for you.

Conclusion

After exploring the ins and outs of broker fees in NYC, it’s clear that understanding the rules and regulations surrounding these fees is crucial when searching for a new apartment. By knowing your rights and options, you can make informed decisions and possibly save some money in the process.

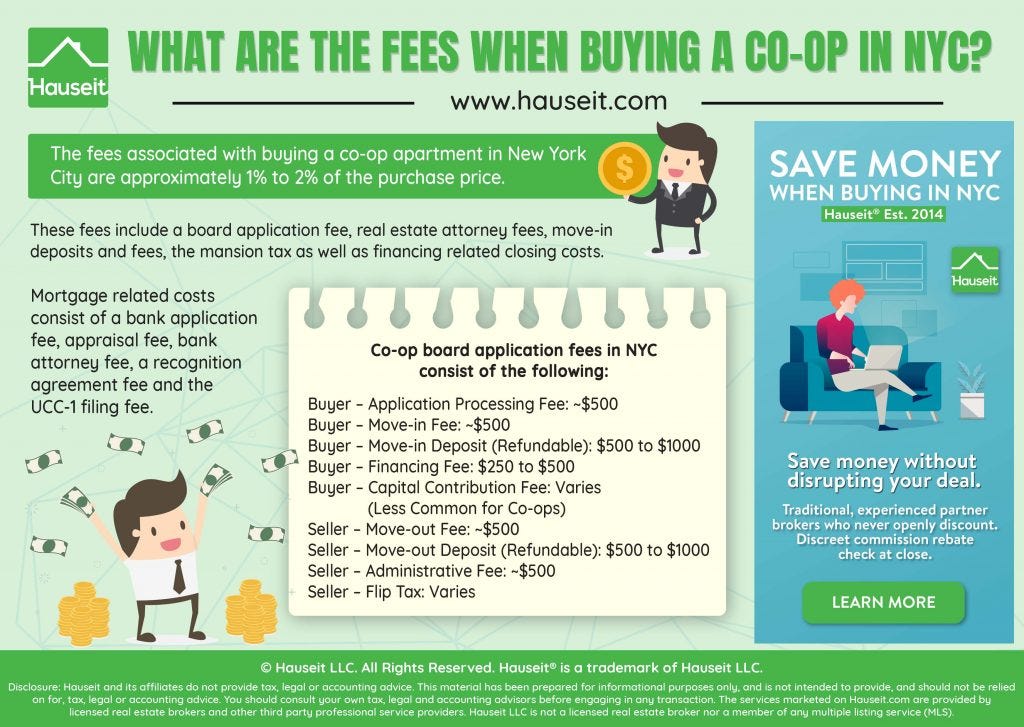

Image courtesy of hauseit.medium.com via Google Images

Image courtesy of hauseit.medium.com via Google Images

Remember, if you find yourself facing a broker fee, don’t be afraid to negotiate. With the right approach and understanding of your power as a renter, you may be able to lower the fee or find a no-fee apartment that suits your needs.

So, as you embark on your apartment hunting journey in New York City, armed with this knowledge, you can navigate the world of broker fees with confidence and make the best choice for your new home.

Work with the Real Estate Rebate Team

Real Estate Rebates Team is a top real estate brokerage firm in NYC and NJ, dedicated to delivering exceptional service and significant savings. Offering up to a 2.5% commission rebate at closing, we pass these savings directly to clients buying or selling homes. Through education and a transparent rebate system, we empower clients to maximize their benefits, with numerous success stories proving our approach. Our online platform allows you to easily calculate potential rebates and find properties that suit your needs. We negotiate the best prices and secure additional incentives at closing, ensuring you get money back whether selling, renting, or buying a condo, co-op, or townhouse. For new developments, we offer even higher rebates on larger commissions. Real Estate Rebates Team helps clients enjoy greater savings and better returns on their real estate transactions.

Frequently Asked Questions (FAQs)

Is it common to pay broker fees for rental apartments in NYC?

Knowing how often people pay these fees helps you see what’s normal in New York City. In NYC, it’s quite common to pay a broker fee when renting an apartment. Many landlords work with brokers to help find tenants, and in return, the broker charges a fee for their services. So, if you’re looking to rent in NYC, be prepared for the possibility of encountering a broker fee.

What percentage of the rent is typically asked for as a broker fee?

Let’s find out how much you might need to save if you’re going to pay a broker fee. Typically, a broker fee in NYC ranges from 12% to 15% of the annual rent. For example, if the yearly rent for an apartment is $30,000, the broker fee could be between $3,600 and $4,500. It’s essential to keep this in mind when budgeting for your new place.

Can I rent an apartment in NYC without paying any broker fees?

We’ll see if it’s possible to skip the broker fee and still get a cool place to call home. Yes, it is possible to rent an apartment in NYC without paying any broker fees. Some landlords don’t use brokers to find tenants, which means you can avoid this extra cost. There are websites and resources that specialize in listing apartments without broker fees, so keep an eye out for those if you prefer to rent without paying a fee.

Begin your search and start earning cash back!

Generated by Texta.ai Blog Automation

Image courtesy of via

Image courtesy of via