Unlock the secrets to successfully buying an apartment in the bustling streets of NYC. Don’t miss out on this essential guide!

Table of Contents

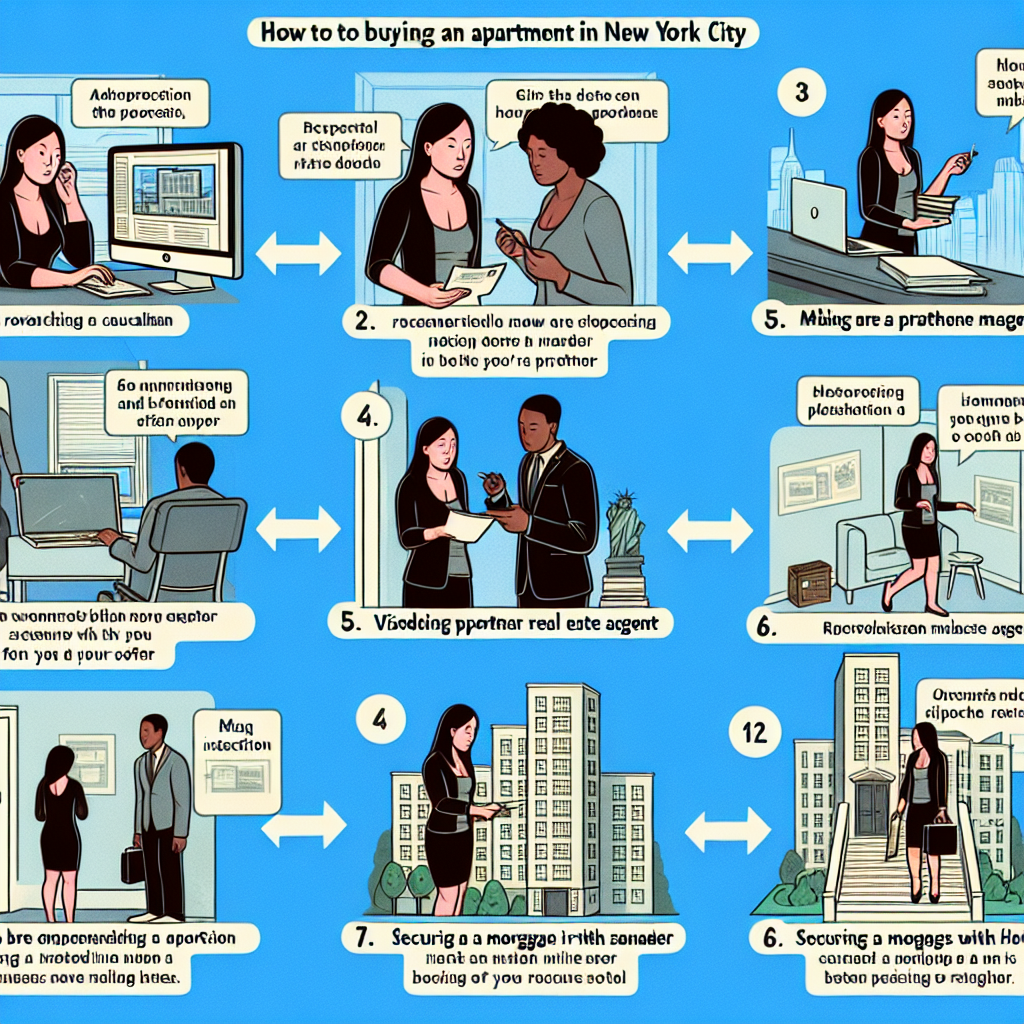

Welcome to NYC Apartment Buying! Have you ever dreamed of owning your own place in the bustling city of New York? Well, buying an apartment in NYC can be an exciting adventure filled with endless possibilities. In this guide, we will walk you through the process step by step, making it easy for you to understand and navigate.

Welcome to NYC Apartment Buying

Why would anyone want to buy an apartment in New York City, you might ask? Well, NYC is known for its vibrant culture, diverse communities, and endless opportunities. From world-class dining to iconic landmarks, living in NYC can be a dream come true for many. Whether you’re drawn to the energy of Manhattan or the charm of Brooklyn, there’s a neighborhood in NYC for everyone.

What This Guide Will Teach You

Now that you’re excited about the idea of owning an apartment in NYC, let’s dive into what you can expect from this guide. We’ve designed this guide to be easy to follow and full of helpful tips to simplify the apartment buying process for you. You’ll learn about the costs involved, the steps to buying a condo, buying off the plan, and valuable tips to ensure a smooth purchase. So, get ready to embark on your NYC apartment buying journey!

Understanding the Costs

Different Costs Explained

Buying an apartment in NYC involves several costs that you need to consider. The main costs you will encounter include the price of the apartment itself, mortgage payments to your lender, property taxes, and maintenance fees. Each of these costs plays a crucial role in determining the overall affordability of your new home.

What Are Closing Costs?

When you finalize the purchase of your apartment, you will encounter closing costs. These costs cover various fees such as title insurance, attorney fees, recording fees, and more. Typically, the buyer is responsible for covering these expenses, but in some cases, the sponsor may agree to pay a portion or all of the closing costs. It’s essential to understand these costs upfront to avoid any surprises during the buying process.

Saving Up for Your Apartment

If you’re thinking about buying an apartment in NYC, it’s crucial to start saving money early. Creating a budget can help you track your expenses and identify areas where you can cut back to save for your dream home. Set realistic savings goals and stick to them to ensure you’re financially prepared for the costs associated with purchasing an apartment in the city.

Steps to Buying a Condo in NYC

When you want to buy a condo in NYC, the first step is to find the right one for you. You can use online tools like real estate websites to search for available apartments. You can also work with a real estate agent who can show you different options based on your preferences and budget.

Making an Offer

Once you find an apartment you like, it’s time to make an offer. Making an offer means telling the seller how much you are willing to pay for the condo. There may be negotiations back and forth where you and the seller agree on a price that works for both of you.

Inspection and Appraisal

Before finalizing the purchase, it’s important to have the condo inspected and appraised. An inspection will check for any hidden issues with the apartment, while an appraisal determines the fair market value. This step ensures that you are getting what you are paying for.

Finalizing the Sale

After the inspection and appraisal, you are close to closing the deal. This is when all the necessary paperwork is completed and signed. You may need a lawyer to help with the legal aspects of the sale. Once everything is in order, you can officially become the owner of your new condo in NYC.

Buying Off the Plan

When it comes to buying an apartment in NYC, one option that you might come across is “buying off the plan.” This method differs from purchasing an existing apartment and offers its own set of advantages and risks. Let’s dive into what this means and how it works in the city.

What Is Buying Off the Plan?

Buying off the plan involves purchasing a property that has not yet been built or completed. Essentially, you are buying directly from the developer based on the plans and specifications of the future construction. This allows for some level of customization and personalization before the building is finished.

| Step | Description |

|---|---|

| 1 | Get pre-approved for a mortgage |

| 2 | Define your budget and prioritize features |

| 3 | Hire a real estate agent familiar with the NYC market |

| 4 | Research neighborhoods and buildings |

| 5 | Attend open houses and schedule viewings |

| 6 | Make an offer and negotiate the price |

| 7 | Perform due diligence and hire an inspector |

| 8 | Sign contracts and close the deal |

Advantages and Risks

One of the primary benefits of buying off the plan is the potential for lower prices compared to already constructed properties. Additionally, you may have the opportunity to choose certain finishes, layouts, or upgrades to suit your preferences.

However, there are risks associated with buying off the plan as well. Delays in construction or changes in the market can affect the final product and its value. It’s essential to do thorough research on the developer’s track record and reputation to minimize these risks.

Role of the Sponsor

In off-the-plan purchases, the sponsor plays a crucial role in facilitating the transaction. The sponsor is typically the developer or a third party who finances and develops the project. They may assist with financing options and covering some closing costs, making the process smoother for buyers.

Understanding the dynamics of buying off the plan can help you determine if this option aligns with your preferences and goals when looking for an apartment in NYC.

Tips for a Smooth Purchase

When it comes to buying an apartment in NYC, having the right professionals on your side can make a world of difference. Real estate agents can help you navigate the complexities of the market and find properties that meet your needs. Lawyers can review contracts and ensure that your interests are protected. Inspectors can uncover any hidden issues with the property before you make a final decision.

Doing Your Research

Before diving into the apartment-buying process, take the time to research the neighborhoods you are interested in. Look into market trends to understand pricing and competition. Familiarize yourself with property values in different areas to make an informed decision. The more knowledge you have, the better equipped you’ll be to make a smart purchase.

Staying Organized

Buying an apartment can involve a lot of moving parts, so it’s essential to stay organized throughout the process. Keep all your financial documents in one place for easy access. Create checklists of tasks that need to be completed, such as scheduling inspections or submitting paperwork. By staying organized, you can avoid feeling overwhelmed and ensure that everything runs smoothly.

Conclusion and FAQs

Summary of Key Points

In this guide, we’ve covered the essential steps and tips for buying an apartment in NYC. From understanding the costs involved to finalizing the sale, we’ve broken down the process into manageable steps. By saving up for your apartment, finding the right condo, and working with professionals, you can navigate the NYC real estate market with ease.

Frequently Asked Questions

Here are answers to some common questions about buying an apartment in NYC:

Can you buy an apartment in NYC if you’re not a resident? Yes, non-residents can buy property in NYC. However, it’s essential to seek legal advice and understand the tax implications.

Begin your search and start earning cash back!

What documents do you need to buy an apartment in NYC? You will typically need documents like proof of income, identification, tax returns, and bank statements. Your real estate agent or lawyer can provide a detailed list of required paperwork.