Discover the essential steps and tips for purchasing your first co-op unit in this comprehensive guide for first-time buyers.

Table of Contents

Introduction: Welcome to the World of Co-Op Units

Welcome to the fascinating world of co-op units! Today, we will embark on a journey to explore what a co-op unit is and why it could be an excellent choice for you. Understanding the ins and outs of co-op units will help you navigate the process of buying your first home smoothly. So, let’s dive in!

What is a Co-Op Unit?

First things first, let’s define what a co-op unit is. A co-op, short for cooperative, is a type of housing where residents own shares in a corporation that owns the entire property. Unlike traditional homeownership, where you own your individual unit and a portion of common areas, in a co-op, you own shares in the entire building.

Why Consider Buying a Co-Op Unit?

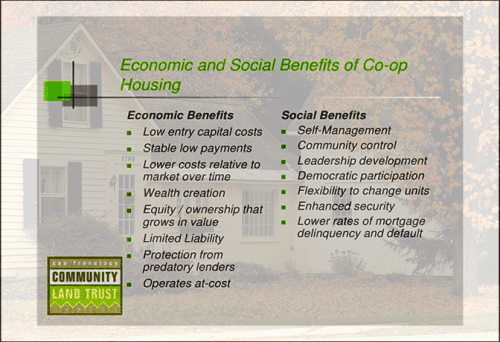

Now that you know what a co-op unit is, you might be wondering why it’s a great choice. One of the significant advantages of living in a co-op community is the sense of belonging and camaraderie. You’ll be part of a close-knit community where residents work together to maintain the property and make decisions collectively. Additionally, buying a co-op unit can often be more affordable than purchasing a traditional home, making it an attractive option for many first-time buyers.

Understanding How Co-Op Units Work

When it comes to co-op units, there is something called a co-op board. This board is made up of individuals who are elected to oversee the management of the co-op building. They play a key role in decision-making and setting rules and policies for the co-op community.

Membership and Shares

Now, let’s talk about how you become part of a co-op community. When you buy a co-op unit, you are actually purchasing shares in the cooperative corporation that owns the entire building. This is different from traditional home ownership where you own the physical space. As a shareholder in the co-op, you are granted the right to live in a specific unit within the building.

The Process of Buying a Co-Op Unit

When you decide to buy a co-op unit, the first step is to search for one that fits your needs. You can start by browsing online listings on real estate websites or working with a real estate agent who specializes in co-op units. Look for units that are up for sale and pay attention to their location, size, amenities, and asking price.

Image courtesy of themortgagereports.com via Google Images

Applying to the Co-Op Board

After finding a co-op unit you like, you’ll need to apply to the co-op board. This step is crucial because the board has the power to approve or deny your application. They will review your financial situation, background, and reasons for wanting to live in the co-op. It’s important to submit all required documents and be prepared for an interview with the board members.

Closing the Deal

Once the co-op board approves your application, you can move on to closing the deal. This involves signing legal paperwork, paying closing costs, and getting the keys to your new co-op unit. Make sure to hire a real estate attorney to guide you through the closing process and ensure everything is legally sound. After closing, you can start moving into your new home and enjoying the benefits of co-op living.

Living in a Co-Op Unit

Living in a co-op unit comes with a set of rules and responsibilities that help maintain a harmonious community. These rules can range from guidelines on noise levels to regulations on pet ownership. It’s important to familiarize yourself with these rules to ensure a smooth living experience for you and your neighbors.

Community Benefits

One of the perks of living in a co-op unit is the sense of community that comes with it. You’ll have the opportunity to get to know your neighbors and participate in various social activities organized within the co-op. This can lead to lasting friendships and a support system right at your doorstep.

Tips for First-Time Buyers

As a first-time buyer looking to purchase a co-op unit, it’s crucial to establish a budget and plan your finances accordingly. Start by determining how much you can afford to spend on a down payment and monthly mortgage payments. Consider additional costs such as maintenance fees, property taxes, and utilities. Creating a detailed budget will help you stay on track and avoid overextending yourself financially.

| Step | Description |

|---|---|

| 1 | Research different co-op buildings in your desired neighborhood |

| 2 | Attend open houses and tours to get a sense of the units available |

| 3 | Review the financial documents of the co-op to understand its financial health |

| 4 | Consult with a real estate agent specializing in co-op sales |

| 5 | Get pre-approved for a mortgage to understand your buying power |

| 6 | Submit a co-op board application for approval |

| 7 | Attend an interview with the co-op board to discuss your candidacy |

| 8 | Receive approval from the co-op board and finalize the purchase |

Image courtesy of www.mtpr.org via Google Images

Common Mistakes to Avoid

When buying a co-op unit for the first time, there are a few common mistakes that you should be aware of and try to avoid. One of the most significant mistakes is not getting pre-approved for a mortgage before starting your search. Pre-approval gives you a clear idea of how much you can borrow and demonstrates to sellers that you are a serious buyer. Another common mistake is skipping the home inspection. A thorough inspection can uncover potential issues with the property that may not be visible during a walkthrough. Lastly, it’s important to avoid making any major financial changes, such as taking on new debt or changing jobs, during the buying process as this can impact your mortgage approval.

Conclusion: Recap and Final Thoughts

Throughout this guide, we have explored the world of co-op units and delved into the details of buying your first one. Let’s recap what we’ve covered and leave you with some final thoughts on this exciting journey.

What is a Co-Op Unit?

We started by defining what a co-op unit is. Unlike traditional homes, in a co-op, you own shares in the entire building instead of a specific unit. This unique setup offers a sense of community and shared responsibility among residents.

Why Consider Buying a Co-Op Unit?

We also discussed the benefits of buying a co-op unit. From potential cost savings to a strong sense of community living, co-op units offer a different lifestyle that might be appealing to you.

The Process of Buying a Co-Op Unit

We walked through the steps involved in buying a co-op unit, from finding one for sale to applying to the co-op board and closing the deal. Each step is crucial in ensuring a smooth and successful purchase.

Living in a Co-Op Unit

Living in a co-op unit comes with its own set of rules and responsibilities. Understanding these community guidelines and benefits will help you adjust to your new home smoothly.

Tips for First-Time Buyers

For first-time buyers, we provided practical advice on budgeting, financial planning, and common mistakes to avoid. These tips will help you navigate the buying process with confidence.

In conclusion, buying a co-op unit is an exciting opportunity to become part of a unique community and ownership structure. By understanding the process, benefits, and responsibilities involved, you can make a well-informed decision that suits your lifestyle and preferences. Happy house-hunting!

Frequently Asked Questions (FAQs)

What is the difference between a co-op and a condo?

When it comes to housing, co-op units and condominiums (condos) are two different options. In a co-op, you don’t actually own your unit like you would in a condo. Instead, you become a shareholder in a cooperative corporation that owns the entire building. This means you have a say in how the building is run and maintained. In contrast, condos involve owning your unit outright, and you are responsible for its upkeep. While condos offer more ownership freedom, co-ops often have stricter rules and regulations due to communal living.

Is it difficult to sell a co-op unit?

Begin your search and start earning cash back!

Selling a co-op unit can be a bit more challenging compared to selling a traditional home or condo. This is because co-op boards typically have the authority to approve or reject potential buyers. They often require detailed financial information and conduct interviews to ensure new residents are a good fit for the community. Be prepared to work closely with the board and provide all necessary documentation to facilitate a smooth sale. It may take a bit longer, but with patience and cooperation, selling a co-op unit can be a manageable process.