Curious about the tax rates on new NYC condos? Find out everything you need to know in our comprehensive guide.

Table of Contents

Introduction: The Buzz About New Condos in NYC

Are you intrigued by the gleaming skyscrapers and bustling lifestyle of New York City? Well, hold onto your hats because we’re about to dive into the exciting world of new condo developments in the Big Apple! Today, we’re going to unravel the mystery behind why tax rates play a crucial role in these modern marvels. So, buckle up and get ready to explore the buzz surrounding new condo developments in NYC!

Chapter 1: What’s Up with Taxes on New NYC Condos?

When it comes to taxes on new condos in NYC, things can get a bit tricky. Have you ever wondered why the taxes on new construction condos are different from other properties? Let’s dig into the basics to understand why taxes on new NYC condos are higher.

A. Taxes and New Buildings

Imagine you’re building a brand-new LEGO set. It’s shiny, new, and everyone wants to play with it. Just like that LEGO set, new condos in NYC are fresh and appealing. Because they’re new and have all the latest features, the government thinks they’re more valuable. As a result, the taxes on new condos can be higher compared to older properties. So, when you see a gleaming skyscraper going up, remember that it may come with higher tax bills.

B. Comparing Old vs. New Condo Taxes

Now, let’s compare taxes on an old, creaky building with taxes on a fancy, new condo. The older building has been around for a while and might not have all the modern amenities that a new condo offers. This difference in value affects how much tax you have to pay. New condos often have higher property taxes because they’re seen as more valuable due to their newness and luxury features. It’s like buying a new toy compared to a used one—the brand new toy might cost more, and so do new condos in terms of taxes.

Chapter 2: The Cost of Building a New Condo in NYC

Building a new condo in New York City involves several significant costs. One of the first expenses to consider is the price of the land where the building will be constructed. In bustling areas like NYC, land prices can be incredibly high due to the high demand for real estate. Developers must secure a suitable plot of land, which can be a substantial investment.

Image courtesy of blocksandlots.com via Google Images

Additionally, the construction costs of a new condo in NYC are considerable. This includes the expenses involved in hiring architects, engineers, construction workers, and obtaining the necessary permits. High-quality materials and modern amenities also contribute to the overall cost. All these factors add up to make building a new condo in NYC a pricey endeavor.

B. How Building Costs Affect Taxes

The cost of building a new condo in NYC directly impacts the property taxes that owners will have to pay. Since property taxes are calculated based on the assessed value of the property, which includes the land and building, the higher the construction costs, the higher the assessed value will be. This, in turn, leads to higher property taxes for owners of new condos.

Chapter 3: The Price You Pay for Living in the New

When you choose to live in a brand-new condo in New York City, you are not just paying for a place to live. You are investing in cutting-edge architecture, modern amenities, and the latest technology. These luxurious features come at a price, and that price is reflected in the taxes you pay. New development condos are often equipped with state-of-the-art facilities such as smart home systems, energy-efficient appliances, and high-end finishes. While these features enhance your living experience, they also contribute to the overall cost of the property and subsequently, the taxes you owe.

Tax Breaks and Benefits

Despite the higher tax rates associated with new development condos in NYC, there may be some relief available in the form of tax breaks and benefits. The government sometimes offers incentives to encourage investment in new construction properties. These incentives could include tax deductions for certain eco-friendly upgrades, exemptions for a period of time after the completion of the building, or even reduced property tax rates for a specific number of years. It’s essential to explore these potential benefits with your real estate agent or tax advisor to ensure you are taking advantage of all available opportunities to save on taxes.

| Neighborhood | Property Tax Rate (%) | Transfer Tax Rate (%) | Mansion Tax Rate (%) |

|---|---|---|---|

| Manhattan | 0.80% | 1.00% | 1.00% |

| Brooklyn | 0.90% | 1.425% | 1.25% |

| Queens | 0.90% | 1.425% | 0.25% |

| Bronx | 1.05% | 1.425% | 0.50% |

| Staten Island | 1.05% | 1.425% | 1.00% |

Chapter 4: How to Plan for Your New Condo Taxes

When you purchase a new condo in NYC, you will receive a tax bill for the property. This bill includes important information about the taxes you owe on your new home. It’s essential to understand this document to effectively plan and budget for your taxes.

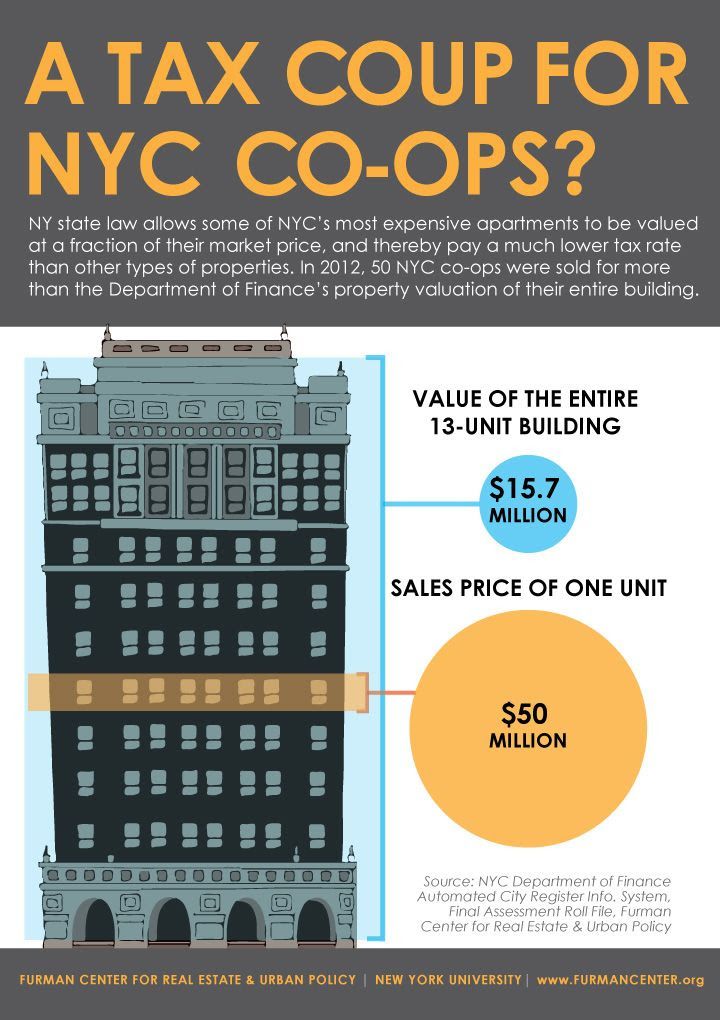

Image courtesy of furmancenter.org via Google Images

Strategies to Save on Taxes

While taxes on new condo developments in NYC may be higher, there are strategies you can consider to potentially save on your tax bill.

1. Homestead Exemption: In some cases, you may qualify for a homestead exemption, which reduces the taxable value of your property and subsequently lowers your tax bill.

2. Appeals Process: If you believe that your property has been assessed incorrectly, you have the option to appeal the assessment. By providing evidence to support a lower assessment, you could potentially reduce your taxes.

3. Tax Incentives: Keep an eye out for any available tax incentives for new condo owners in NYC. Some programs may offer tax breaks or rebates that can help lessen the financial burden of property taxes.

4. Tax-Deferred Savings Accounts: Consider setting up a tax-deferred savings account specifically for your property taxes. By contributing regularly to this account, you can ensure that you have the funds available when tax bills are due.

By understanding your tax bill and implementing smart strategies to save on taxes, you can effectively plan for and manage the tax implications of owning a new condo in NYC.

Conclusion: Getting Smart with Your New Condo

As we wrap up our exploration of tax rates on new condo developments in the vibrant city of New York, it’s crucial to emphasize the significance of being informed buyers. Understanding why taxes are higher on new construction condos in NYC and the factors that contribute to this increase can help you make smarter decisions when it comes to purchasing your dream home.

By delving into the differences between taxes on new buildings versus existing ones, you can gain a deeper insight into the financial implications of your investment. The cost of building a condo directly affects the taxes you’ll be paying, so being aware of these expenses can aid you in planning your budget effectively.

Living in a brand-new condo often comes with luxurious features and amenities that enhance your quality of life. However, these amenities also contribute to higher property taxes. Understanding these trade-offs can help you weigh the pros and cons of purchasing a new development condo in NYC.

By familiarizing yourself with your tax bill and exploring potential strategies to save on taxes, you can take proactive steps to minimize your financial burden in the long run. Planning ahead and budgeting for your new condo’s taxes can ensure that you’re financially prepared for the responsibilities that come with homeownership.

Ultimately, being smart with your new condo means staying informed, understanding the tax implications, and planning strategically for your financial future. With the knowledge and insights gained from this guide, you can navigate the world of new NYC condo taxes with confidence and make informed decisions that align with your long-term goals.

FAQs

Why are new condos in NYC taxed differently?

New condos in NYC are taxed differently because of the way the government assesses property taxes. When a new condo building is constructed, its value is often reassessed, leading to potentially higher taxes compared to older properties. Additionally, new condos may come with added amenities or features that increase their overall value, resulting in higher tax obligations.

Can I get tax breaks on my new condo?

Depending on certain factors, you may be eligible for tax breaks on your new condo in NYC. Some tax breaks or incentives are available for new construction properties to encourage homeownership and development. To find out if you qualify for any tax breaks, it’s best to consult with a tax professional or do some research on the specific programs that may apply to your situation.

How can I budget for my new condo’s taxes?

When budgeting for your new condo’s taxes, it’s important to consider the potential increase in property taxes compared to older properties. You can estimate your taxes by looking at the current tax rates and assessments in the area where your condo is located. It’s also a good idea to set aside some money each month for property taxes to ensure you’re prepared when the tax bill arrives.

Begin your search and start earning cash back!

Generated by Texta.ai Blog Automation