Discover the secrets to successfully financing coops in the competitive NYC property market and how to navigate the process effectively.

Table of Contents

Introduction to Financing Coops in NYC

Looking to find your dream home in the bustling city of New York? Well, you’ve come to the right place! Today, we are going to embark on a journey to understand the ins and outs of financing coops in the vibrant real estate market of New York City.

What is a Coop?

Before we dive into the world of financing coops, let’s first understand what a coop actually is. A coop, short for cooperative, is a unique type of home ownership where residents own shares in a corporation that owns the building. Each resident has the right to occupy a unit in the building based on the number of shares they own. It’s like being part of a big family where everyone pitches in to maintain the building and make decisions together.

Why are Coops Unique in NYC?

Coops are particularly popular in New York City because of the way the property market is structured. Due to historical reasons and strict regulations, coops make up a substantial part of the real estate landscape in the city. They tend to be more affordable than traditional condos and offer a sense of community living that many New Yorkers appreciate.

Understanding the Costs

Diving into the expenses of owning a coop in New York City can give you a clear picture of what to expect financially. Let’s break down the costs involved in purchasing and maintaining a coop.

Initial Purchase Price

When you decide to buy into a coop, you’ll need to consider the initial purchase price. This is the amount you will pay upfront to become a part-owner of the cooperative. The price can vary depending on the location, size, and amenities of the coop. It’s essential to budget accordingly and factor in additional costs like closing fees and legal expenses.

Monthly Maintenance Fees

Aside from the purchase price, coop owners also need to account for monthly maintenance fees. These fees cover the costs of maintaining the building, repairs, utilities, and other shared expenses. The amount of the monthly fees can fluctuate based on the coop’s financial health and ongoing maintenance needs. It’s crucial to include these fees in your budget planning to ensure you can comfortably afford to live in a coop.

Exploring New Developments

When it comes to finding a new place to call home in New York City, keeping an eye on the latest developments is key. Let’s take a closer look at the exciting opportunities that new condo developments in NYC and new construction in Manhattan offer for coop living.

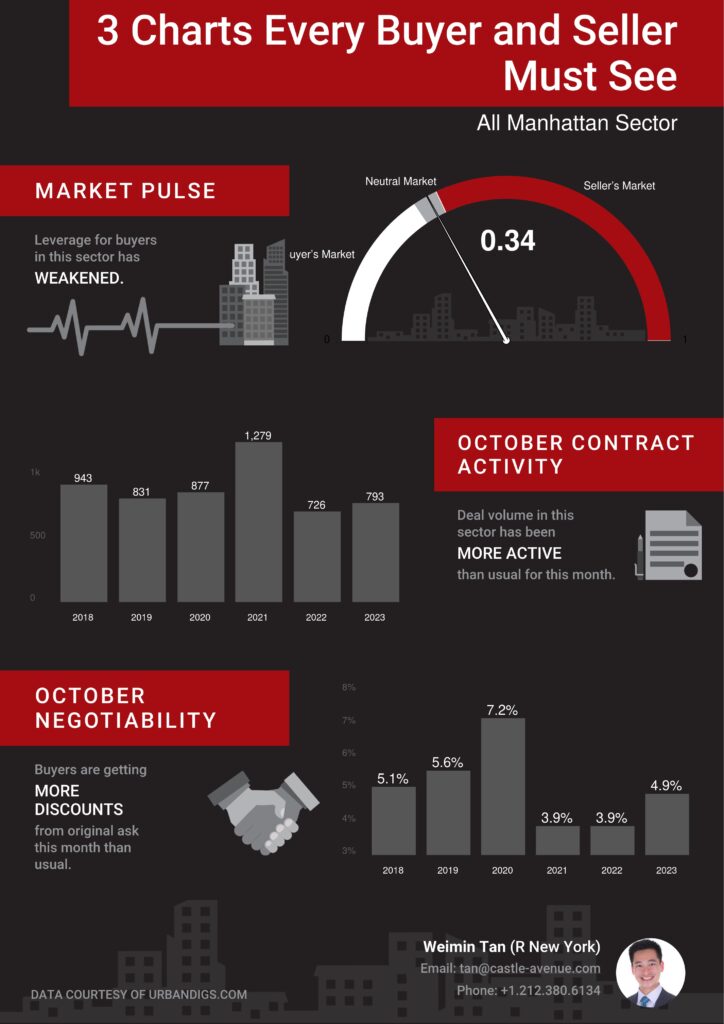

Image courtesy of www.castle-avenue.com via Google Images

What’s Trending in Manhattan

Manhattan is known for its vibrant neighborhoods and iconic skyline, and new condo developments continue to reshape the cityscape. From sleek high-rises with panoramic views to luxurious amenities like rooftop pools and fitness centers, there’s something for everyone in the Big Apple.

As neighborhoods evolve and new buildings rise, keep an eye out for upcoming projects that could be your next dream home. Whether you’re looking for a cozy coop in a historic brownstone or a modern condo in a bustling new development, Manhattan has options to suit every style and budget.

Comparing Coops to Condos

When exploring new developments in NYC, it’s important to understand the differences between coops and condos. While both offer the convenience of city living, coops typically come with a unique ownership structure that sets them apart from traditional condominiums.

Coop owners purchase shares in a corporation that owns the building, giving them the right to occupy their unit. Monthly maintenance fees cover building expenses, property taxes, and sometimes even utilities, making budgeting simpler for residents. On the other hand, condo owners own their individual units outright and are responsible for all maintenance costs.

Getting a Loan for a Coop

When it comes to buying a coop in New York City, most people need to borrow money to make their dream home a reality. Let’s explore how you can secure a loan for a coop and what you need to know about the process.

| Topic | Description |

|---|---|

| Financing options | Explore various financing options available for cooperatives in NYC, including traditional mortgages, co-op loans, and financing through specialized lenders. |

| Co-op financial health | Learn how to assess the financial health of a cooperative before investing, including reviewing financial statements, reserves, and maintenance fees. |

| Market trends | Stay informed on the current trends in the NYC property market, including pricing fluctuations, demand trends, and emerging neighborhoods. |

| Co-op regulations | Understand the regulations governing cooperatives in NYC, including resale restrictions, board approval processes, and common charges. |

Coop Loan Basics

A coop loan is a type of mortgage specifically designed for cooperative apartments. Unlike traditional mortgages for condos or houses, coop loans involve financing a share of a cooperative corporation rather than owning real property outright. This means that when you buy into a coop, you are buying shares in the cooperative corporation that entitles you to a proprietary lease for your unit.

When applying for a coop loan, lenders will consider the financial health of the cooperative as a whole, in addition to your personal financial situation. They will review the coop’s financial statements, reserve funds, and maintenance fees to assess the risk of lending to you. Keep in mind that coop loans may have different requirements and terms compared to conventional mortgages, so it’s crucial to work with a lender familiar with coop financing.

Tips for Securing a Loan

Here are some tips to help you increase your chances of securing a loan for a coop:

1. Improve your credit score: A higher credit score can make you a more attractive borrower and potentially qualify you for better loan terms.

2. Save for a larger down payment: Coop loans often require a larger down payment compared to traditional mortgages. Saving up more money upfront can help you meet this requirement.

3. Get pre-approved: Before starting your coop search, get pre-approved for a loan. This can show sellers that you are a serious buyer and speed up the closing process.

4. Work with a coop-savvy lender: Look for lenders who specialize in coop financing. They can guide you through the unique requirements and complexities of coop loans.

By understanding the basics of coop loans and following these tips, you’ll be well-equipped to navigate the loan process and secure the financing you need to purchase your dream coop in New York City.

Making the Move: Steps to Buying a Coop

When you’ve decided that living in a coop in New York City is the right choice for you, it’s time to take the next steps towards owning your own piece of the Big Apple. Here are the key stages you’ll go through when purchasing a coop:

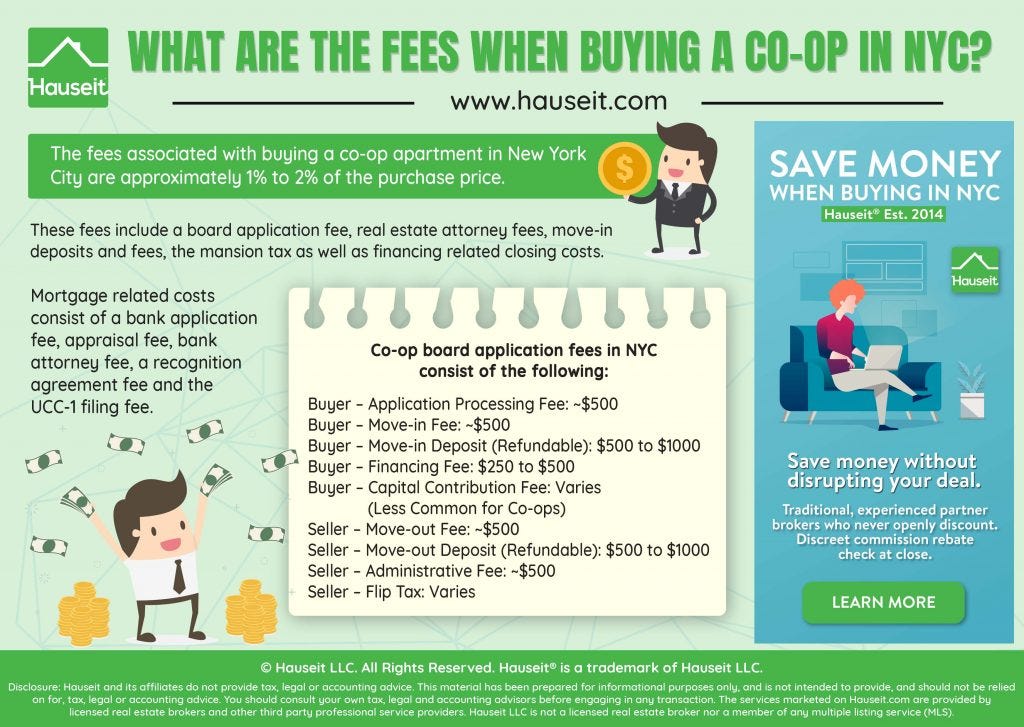

Image courtesy of hauseit.medium.com via Google Images

Finding the Right Coop

The first step in buying a coop is finding the perfect one for you. You’ll need to consider factors like location, size, amenities, and price. Start your search by working with a real estate agent who specializes in coops in NYC. They can help you narrow down your options and find a coop that fits your needs and budget.

Undergoing the Approval Process

One of the unique aspects of buying a coop in NYC is the approval process by the coop board. Once you’ve found a coop you like, you’ll need to submit an application to the board. They will review your financials, conduct an interview, and make a decision on whether to approve you as a potential shareholder in the coop. Be prepared to provide detailed financial information and references as part of this process.

Conclusion: Is a Coop Right for You?

After exploring the ins and outs of coops in New York City, you may be wondering if this type of housing is the right fit for you. Coops offer a unique way to own property in the city, but they also come with their own set of rules and considerations. Let’s take a moment to reflect on whether a coop is the right choice for your NYC housing needs.

Living in a coop can offer communal living with shared amenities and a sense of community. If you value a close-knit living environment and are willing to abide by the coop’s rules and regulations, then a coop might be a great option for you. It’s essential to consider your lifestyle and preferences before making a decision.

On the other hand, if you prefer more autonomy and flexibility in your living situation, a condo might be a better fit. Condos typically offer more freedom in terms of renovations and renting out your unit, which can be appealing to some buyers. Consider what aspects of homeownership are most important to you when weighing your options.

Additionally, if you’re interested in new condo developments in NYC, coops may not always be the best choice. Condos often offer modern amenities and trendy features that may not be found in older coop buildings. If you’re looking for a sleek, contemporary living space, exploring new construction projects in Manhattan might be more aligned with your preferences.

Ultimately, the decision of whether a coop is right for you comes down to your personal preferences, financial situation, and lifestyle. Take the time to research and tour different properties, consult with a real estate agent, and weigh the pros and cons of coop ownership before making a decision. With careful consideration, you can find the perfect housing option that suits your needs and preferences in the bustling city of New York.

Frequently Asked Questions (FAQs)

FAQ1

What is the main difference between a coop and a condo in New York City?

In New York City, a coop is a type of housing where residents own shares in a corporation that owns the building, while a condo is more like traditional homeownership where you own your individual unit outright.

One key distinction is that coops typically require board approval for purchases and rentals, while condos have more flexibility in this regard.

FAQ2

How much does it cost to build a coop or condo in Manhattan?

The cost of building a coop or condo in Manhattan can vary greatly depending on the location, size, and level of luxury. On average, the cost of new construction in Manhattan can range from several hundred thousand dollars to millions of dollars.

This cost includes not only the construction of the building itself but also permits, land acquisition, design fees, and other expenses that are part of the development process.

Begin your search and start earning cash back!

Generated by Texta.ai Blog Automation