Unlock the secrets to buying a house: from navigating the market to negotiating the deal, this guide has you covered.

Table of Contents

Buying a house is a big adventure! But, before you dive in, it’s important to know some key things. This guide is here to help you understand everything you need to know about real estate. Learning the basics about buying a home can help you make smart choices. After all, a house isn’t just a building; it’s where you and your family will make memories together.

First, let’s explore what real estate is. Real estate includes homes, land, and buildings. It’s important because it helps people find places to live and build their lives. Understanding real estate helps you see the whole picture when you are looking to buy a house.

What is Real Estate?

Real estate is a term used to describe property, which includes land and anything built on it, like houses or stores. When you think about buying a house, you are actually getting into the world of real estate. So, knowing more about it can really help you along the way. Real estate is important because it can be a big part of your life for many years.

Why is it Important?

Now, you may wonder why learning about real estate matters. Well, buying a house is a huge decision, often one of the biggest you’ll ever make. It’s super important to learn about the things to know when buying a house. This knowledge helps you avoid surprises and make choices that fit your dreams and needs. In this blog, we’ll guide you through the process of buying property, so you know what to expect when buying your first house and can feel confident in your decisions.

Things to Know When Buying a House

Buying a house is a big step, and there are many things to know when buying a house. It’s important to think carefully about your choices. In this section, we will go over some essential tips for buying a home that can help you make the best decisions.

Setting Your Budget

The first thing to do is set your budget. This means figuring out how much money you can spend on a house. You need to think about how much you can save for a down payment, which is the money you pay upfront. Many homes need a down payment of around 20% of the price. This means if a house costs $200,000, you need to save $40,000 just for the down payment!

Besides the down payment, there are other costs. These can include closing costs, which are fees that come when you buy a house. Make sure to plan for property taxes and maintenance, like fixing roofs and plumbing too. This way, you won’t be surprised later.

Choosing the Right Location

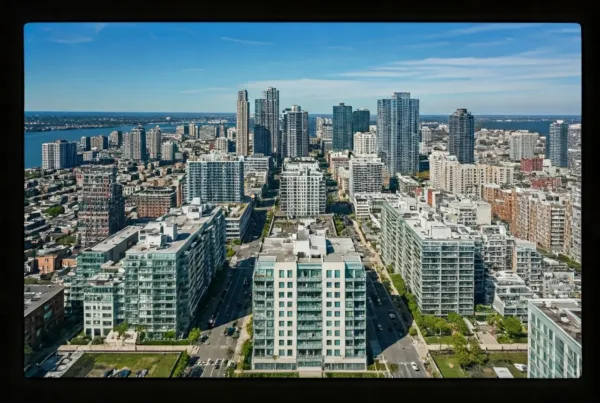

Next, let’s talk about location. The spot where your house is can change everything! Good schools, parks, and stores nearby can make living in that house much nicer. When choosing, think about what is important for you and your family. Do you want to be close to work? Or maybe near your friends? Pick a location that fits your needs and lifestyle.

It’s also smart to consider safety in the area. Check out crime rates and community resources. A safe and welcoming neighborhood can make a big difference in how much you enjoy your new home.

The Process of Buying Property

When you’re thinking about buying a house, it’s helpful to know the entire process of buying property. This journey can feel a bit tricky, especially if it’s your first time. But don’t worry! We’re here to guide you through each step, so you know what to expect when buying your first house.

Finding a Real Estate Agent

The first step in buying a house is finding a real estate agent who can help you. A real estate agent is a special person who knows a lot about houses and can help you find the right one. Look for someone who is friendly, experienced, and listens to what you need. Ask friends or family for recommendations, or look online. A good agent will make the home buying experience easier and more fun.

House Hunting

Once you have an agent, it’s time for some house hunting. This means searching for homes that interest you. Your agent will help you find listings that match your needs. When you visit homes, pay close attention. Look at the size of each room and imagine how your furniture would fit. Don’t forget to check if the house is in a good neighborhood and close to schools or parks. Feeling comfortable in the area is really important!

Making an Offer

When you find a house you like, it’s time to make an offer. This is when you tell the seller how much money you are willing to pay. You can work with your real estate agent to decide on a fair price. Once the seller accepts your offer, you’ll sign some papers, and the home will be taken off the market just for you!

Getting a Mortgage

Now that your offer is accepted, you’ll need to get a mortgage. A mortgage is a loan that helps you pay for the house. You will pay it back little by little, usually over 15 to 30 years. There are different types of loans, and your bank or lender can help you choose the one that’s best for you. They will look at your income and credit score to see how much money you can borrow.

Home Buying Considerations

When you’re thinking about buying a house, there are many important home buying considerations that go beyond just the price and where the house is located. It’s not just about finding a nice place to live. You want to make sure that the home you choose is a good choice for you and your family in the long run.

Home Inspections

A home inspection is like a health check-up for a house. Before you buy, it’s very important to have an inspector look closely at everything, from the roof to the plumbing. Inspectors check for issues that could be costly to fix later on, like leaks or problems with the foundation. This way, you can be sure that your new house is safe and sound before you move in. You wouldn’t want to find out there’s a hidden problem after you’ve already bought the home!

Homeowner Insurance

Once you buy a house, you need to keep it safe, just like you would your toys or your bike. This is where homeowner insurance comes in. It protects your home and your belongings from things like fire or theft. If something bad happens, this insurance can help pay for repairs or replace lost items. Knowing what your homeowner insurance covers is very important, as it keeps you and your family secure in your new home.

Tips for Buying a Home

Buying a home can be exciting but also a bit overwhelming. Here are some tips for buying a home to help you along the way. With these tips, you can feel more confident and organized as you search for your perfect place.

| Step | Description |

|---|---|

| 1 | Check your credit score to determine your eligibility for a mortgage. |

| 2 | Get pre-approved for a mortgage to establish your budget. |

| 3 | Research different neighborhoods to find the right location for your new home. |

| 4 | Hire a real estate agent to help you find properties that meet your criteria. |

| 5 | Attend open houses and schedule private showings to view potential homes. |

| 6 | Make an offer on a house and negotiate with the seller if needed. |

| 7 | Have a home inspection done to check for any potential issues with the property. |

| 8 | Finalize your mortgage loan and complete all necessary paperwork. |

| 9 | Closing day – sign the final paperwork, pay closing costs, and receive the keys to your new home. |

Staying Organized

One of the best things you can do is stay organized. Keep a folder or a notebook just for your home buying journey. You can collect all important papers, like your budget, lists of houses you liked, and contact information for your real estate agent. Also, write down important dates, like when you plan to visit houses and when you need to make decisions. This will help you keep everything straight and make the process easier.

Being Ready to Negotiate

Another important tip is to be ready to negotiate. This means you should be prepared to talk about the price of the home and other details with the seller. Sometimes the price can go up or down based on what you both agree on. It’s good to think about what you want to offer and how much you’re willing to pay. Practicing how to discuss prices politely can make a big difference. Remember, it’s a normal part of the process of buying property.

Following these tips for buying a home will help you have a smoother experience. Being well-prepared can make you feel calmer and more in control while looking for your new home!

Conclusion

Buying a house can feel like a big adventure, and it’s important to know what you are getting into. From understanding what real estate is to navigating through the process of buying property, there are many things to learn. We have covered everything you need to know about real estate to help you make smart choices.

When you’re ready to make this big decision, there are many things to know when buying a house. Remember to set a budget that includes saving up for a down payment, and pick a location that suits your needs. It’s also crucial to think about home buying considerations, like getting a home inspection and having homeowner insurance, to protect your investment.

With our tips for buying a home, you can stay organized and be ready to negotiate. This will make your home buying journey smoother and less stressful. So, as you prepare to take this important step, keep these ideas in mind. The more you know, the easier it will be to find the perfect home for you!

Frequently Asked Questions (FAQs)

Many people have questions when it comes to buying a house. It can feel confusing and a little scary, especially if it’s your first time. Let’s answer some common questions that can help make things clearer for you.

What are the first steps I should take when buying a house?

Before you start looking for a home, you should first figure out your budget. This means looking at your finances and deciding how much money you can spend. After that, consider finding a real estate agent to help you. They can guide you through the whole process of buying property.

Do I need a real estate agent to buy a house?

While it’s not required, having a real estate agent can be very helpful. They understand the housing market and can show you houses that fit your needs. They also know how to handle the paperwork, which can save you a lot of time and stress.

How do I know how much I can afford to spend?

To figure out how much you can afford, take a close look at your income and current expenses. It’s a good idea to save for a down payment, which is the money you pay upfront for the house. Don’t forget to budget for other costs, like closing costs and moving expenses.

What should I look for when visiting houses?

When you visit homes, pay attention to the condition of the building and how much space you need. Look out for things like the age of the roof, the plumbing, and whether it feels comfortable for you and your family. Make notes on each house you see to help you remember what you liked or didn’t like.

What happens after I make an offer on a house?

Once you make an offer, the seller will decide whether to accept it, reject it, or make a counteroffer. If your offer is accepted, you’ll need to finalize details, including getting a mortgage and setting a closing date.

Why do I need a home inspection?

A home inspection is when a professional checks the house to find any hidden problems. This can help you avoid buying a house that needs expensive repairs. It’s an important step to ensure the home is a good long-term choice.

What is homeowner insurance?

Begin your search and start earning cash back!

Homeowner insurance is a type of insurance that protects your home and belongings. It can cover damages from things like fire, theft, or natural disasters. Getting insurance is an important part of being a responsible homeowner.