When buying a home in New York, it’s crucial to understand the home buying process. Here are some key points to remember:

- Familiarize yourself with the steps involved in purchasing a home in New York, such as finding a real estate agent, getting pre-approved for a mortgage, making an offer, and closing the deal.

- Research the various types of properties available in New York, including condos, co-ops, and single-family homes, and understand the nuances of each type.

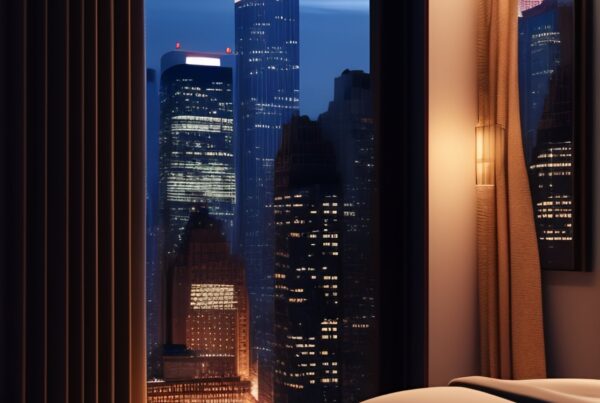

- Learn about the different neighborhoods and boroughs in New York City, as well as the surrounding suburbs, to find the location that best suits your needs and lifestyle.

- Understand the legal and financial aspects of buying a home in New York, such as property taxes, closing costs, and the role of a real estate attorney in the purchase process.

By gaining a solid understanding of the home buying process in New York, you can make informed decisions and maximize your benefits as a savvy shopper.

Identifying potential home buying benefits

To identify potential home buying benefits, consider the following strategies:

- Research various government programs available for homebuyers in New York, such as first-time homebuyer programs, down payment assistance, and low-interest mortgage programs.

- Explore tax benefits related to home ownership, such as deductions for mortgage interest, property taxes, and certain home improvement expenses.

- Understand the potential for home value appreciation in different neighborhoods and regions of New York to maximize long-term financial benefits.

- Consult with a real estate agent or financial advisor to uncover additional home buying benefits specific to your situation and location.

Market analysis: leveraging opportunities

To truly take advantage of the home buying market, it’s essential to understand the opportunities available. Here are some key strategies for savvy New York shoppers:

- Research the current market trends and pricing dynamics to identify potential opportunities

- Leverage low-interest rates and government incentives to maximize buying benefits

- Explore up-and-coming neighborhoods and areas with potential for growth

- Consider working with a real estate agent who has a deep understanding of the New York market and can help you navigate the available opportunities.

Financial strategies for maximizing benefits

To maximize the benefits of buying a home in New York, it’s essential to consider various financial strategies. Here are some key strategies to help you make the most of your home purchase:

- Explore loan options: Look into different types of loans, such as conventional, FHA, or VA loans, and compare interest rates and terms to find the best fit for your financial situation.

- Consider down payment assistance programs: Research local and state programs that offer down payment assistance for first-time homebuyers or low-income individuals.

- Look for tax incentives: Investigate potential tax benefits for homeowners in New York, such as property tax deductions or mortgage interest deductions.

- Negotiate with sellers: Negotiate the purchase price and closing costs to maximize your financial benefits and potentially save money on your home purchase.

By implementing these financial strategies, you can ensure that you make the most of your home buying benefits as a savvy shopper in New York.

Understanding the legal aspects of home buying in NY

When buying a home in NY, it’s important to understand the legal aspects involved to ensure a smooth process. Here are some key points to consider:

- Property Taxes: In New York, property taxes can vary widely by location and are an important factor to consider when budgeting for homeownership.

- Closing Costs: These include fees for the mortgage, attorney, title search, insurance, and other expenses that can add up to 2-5% of the home’s purchase price.

- State Laws: New York has its own set of real estate laws and regulations that may differ from other states, so it’s important to familiarize yourself with these.

- Home Inspections: It’s crucial to thoroughly inspect the property for any structural or legal issues that may affect the purchase.

Understanding these legal aspects will help you navigate the home buying process in New York with confidence.

Choosing the right neighborhood for long-term benefits

When choosing a neighborhood for your new home, consider factors that can provide long-term benefits. Look for areas with good schools, low crime rates, and access to amenities like parks and grocery stores. Neighborhoods with a strong community association can also provide added benefits such as neighborhood watch programs and community events, creating a sense of belonging and safety. When you buy a home in the right neighborhood, you’re not just investing in your property, but also in your quality of life.

Negotiation tactics for getting the best deal

When negotiating to buy a home, it’s important to research the market value of similar properties in the area and use that information as leverage. Determine what you are willing to pay and be firm in expressing your preferences during negotiations. Consider the following tactics:

- Offer a quick closing date to appeal to sellers who are eager to move on.

- Be ready to walk away if the terms are not favorable. This signals to the seller that you are serious and may prompt them to reconsider.

- Express your willingness to make immediate repairs or renovations to save the seller time and money.

By using these strategies, you can position yourself to secure the best possible deal on your new home.

Home inspection and assessment for uncovering hidden benefits

When buying a home, it’s crucial to invest in a thorough home inspection. This process can reveal potential issues like water damage, structural problems, or mold that may not be visible during a regular viewing. By carefully assessing the property, you can uncover hidden benefits such as a well-maintained roof or a recently updated HVAC system, which can save you money in the long run. Additionally, a professional home inspection can provide you with negotiation leverage if any issues are discovered, ensuring that you maximize the benefits of your home purchase.

Securing additional benefits: warranties, insurance, and incentives

Homebuyers in New York can secure additional benefits such as warranties, insurance, and incentives to maximize their home buying experience. Some strategies to consider include researching for homes that come with a warranty, understanding the insurance options available to protect the property and obtaining incentives from sellers or developers. These aspects can provide added value and peace of mind as you navigate the home buying process in New York.

Summary: optimizing your home buying benefits in NY

When looking to buy a home in New York, it’s essential to make the most of the available benefits. Here are a few strategies to help you maximize your home buying benefits:

- Research and understand the various incentives and programs available for home buyers in New York.

- Consider working with a real estate agent or broker who has extensive knowledge of the local housing market and can help you navigate the benefits available to you.

- Explore options for first-time homebuyer programs, down payment assistance, and tax credits that could help reduce your overall costs.

- Take advantage of low-interest mortgage rates and explore different loan options to find the best fit for your financial situation.

- Be proactive in reviewing and understanding the terms and conditions of any benefits or programs you may be eligible for to ensure you’re maximizing their potential.