Unlock the secrets to purchasing NYC sponsor units with our comprehensive guide – discover insider tips for a successful investment!

Table of Contents

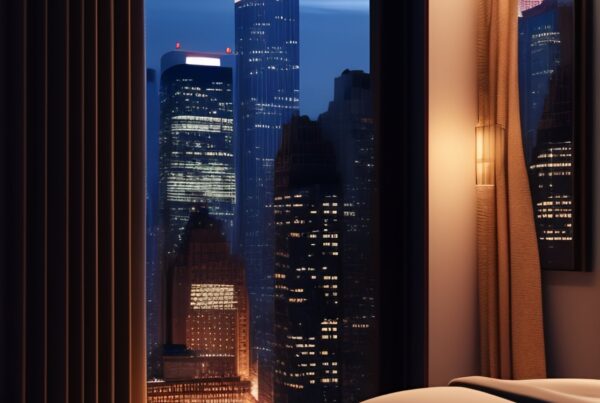

Introduction to NYC Sponsor Units

In the bustling real estate market of New York City, sponsor units play a significant role. These unique properties offer buyers a chance to bypass some of the common hurdles associated with purchasing a home in the Big Apple. Understanding what sponsor units are, the different types available, and the advantages they offer can be key to making an informed decision when entering the NYC real estate scene.

What is a Sponsor Unit?

A sponsor unit is a property in a co-op or condo building that is owned by the original developer or sponsor. These units are typically sold by the sponsor without the need for board approval, making the purchasing process smoother and faster for buyers. Sponsors play a crucial role in the initial sale of units in a building, often offering incentives to attract buyers.

Types of Sponsor Units

There are two main types of sponsor units in NYC: co-op sponsor units and sponsor unit condos. Co-op sponsor units are part of cooperative buildings where residents own shares in the overall corporation. On the other hand, sponsor unit condos are part of condominium buildings where residents own individual units. Depending on your preferences and needs, one type of sponsor unit may be more suitable for you than the other.

Why Buy a Sponsor Unit?

Buying a sponsor unit in NYC comes with its perks. One of the key advantages is the possibility of purchasing a unit without board approval, which can often be a lengthy and uncertain process in traditional co-op or condo purchases. However, it’s essential to weigh the pros and cons of buying a sponsor unit to ensure it aligns with your long-term real estate goals.

Understanding Co-op Sponsor Units

Co-op sponsor units are a unique type of housing option in NYC that offer buyers certain advantages. Let’s delve into what co-op sponsor units are, how they work, and why they might be appealing to potential buyers.

What is a Co-op Sponsor Unit?

A co-op sponsor unit is an apartment within a cooperative building that is owned or controlled by the sponsor. The sponsor is typically the developer or original owner of the building who retains certain units to sell directly to buyers. In a co-op building, shareholders own shares in the corporation that owns the entire building, and buying a sponsor unit means purchasing shares in that corporation.

No Board Approval

One of the key benefits of buying a co-op sponsor unit is the possibility of bypassing the co-op board approval process. Board approval is a common requirement for purchasing a co-op unit, and it involves a thorough review of the buyer’s finances, background, and overall suitability for the building community. With a sponsor unit, buyers may be able to avoid this sometimes lengthy and rigorous approval process, making the purchase simpler and faster.

Things to Consider

When considering buying a co-op sponsor unit, there are a few important factors to keep in mind. Firstly, you’ll want to carefully review the finances of the building and the sponsor to ensure that everything is in good standing. Additionally, be aware of any maintenance fees or potential assessments that may arise. Lastly, if you’re considering making renovations or changes to the unit, be sure to understand any restrictions or guidelines set forth by the sponsor or the co-op board.

Understanding Condo Sponsor Units

Condo sponsor units are a unique type of property in the bustling NYC real estate market. These units offer a different ownership structure compared to co-op sponsor units, providing buyers with distinct advantages and considerations. Let’s delve into what condo sponsor units are, their benefits, and what to keep in mind when looking to purchase one.

What is a Condo Sponsor Unit?

A condo sponsor unit is a residential unit in a condominium building that is owned by the developer or sponsor. When a new condo building is constructed, the sponsor retains ownership of certain units, known as sponsor units. These units are typically brand new and may come with special incentives or pricing from the sponsor.

Benefits of Condo Sponsor Units

One major advantage of buying a condo sponsor unit is the relative freedom it offers compared to co-op sponsor units. Condos generally have fewer restrictions on subletting and renovations, giving buyers more control over their living space. Additionally, condo sponsor units may not require the stringent board approval process that is common with co-op buildings, streamlining the purchasing process.

Things to Consider

As with any real estate investment, there are important factors to consider when buying a condo sponsor unit. Buyers should be aware of potential taxes associated with the property, as well as monthly maintenance fees that come with condo living. Additionally, it’s essential to research the neighborhood where the condo is located to ensure it aligns with your lifestyle and preferences.

The Buying Process for Sponsor Units

When you’ve decided that buying a sponsor unit in NYC is the right choice for you, it’s essential to understand the process involved. From searching for the perfect unit to closing the deal, here is a step-by-step guide to help you navigate the buying process seamlessly.

Searching for Sponsor Units

One of the first steps in buying a sponsor unit is finding the right one for you. Utilize online resources such as real estate websites to search for sponsor units for sale in NYC. Additionally, consider reaching out to real estate agents who specialize in sponsor units to help you find the perfect match.

| Step | Description |

|---|---|

| 1 | Research the Building: Find out about the sponsor, the building’s financial stability, and any pending or ongoing litigation. |

| 2 | Review Offering Plan: Obtain a copy of the offering plan and review it thoroughly, paying attention to financial details, building amenities, and restrictions. |

| 3 | Understand Costs: Determine the total cost of buying the unit, including maintenance fees, closing costs, and any other expenses. |

| 4 | Get Pre-Approved: Obtain a mortgage pre-approval to streamline the buying process and demonstrate to the sponsor that you are a serious buyer. |

| 5 | Consult with a Real Estate Attorney: Hire a lawyer to review the contract and ensure that all terms are fair and legal. |

| 6 | Attend Board Interview: Prepare for a board interview to demonstrate your financial stability, responsibility, and commitment to the building. |

| 7 | Finalize Purchase: Once approved by the board, finalize the purchase by signing the contract, paying the required deposit, and completing the closing process. |

Making an Offer

Once you’ve found a sponsor unit that catches your eye, it’s time to make an offer. Consider factors such as the condition of the unit, pricing in the market, and any potential repairs or renovations that may be needed. Negotiate with the seller to reach a fair price that works for both parties.

Closing the Deal

After your offer has been accepted, the final steps in the buying process begin. This includes completing the necessary paperwork, scheduling inspections to ensure the unit is in good condition, and securing financing if needed. Make sure to review all documents carefully and seek guidance from professionals if necessary to ensure a smooth closing process.

Common Mistakes to Avoid

When buying sponsor units in NYC, it’s essential to be aware of common mistakes that buyers often make. By understanding these pitfalls, you can navigate the purchasing process more effectively and prevent any potential issues down the line. Here are some key errors to avoid:

Not Doing Enough Research

One of the biggest mistakes buyers make is not conducting thorough research before purchasing a sponsor unit. It’s crucial to investigate the unit itself, the building it’s located in, and the history of the sponsor. By doing so, you can uncover any potential red flags and make a more informed decision.

Ignoring Future Costs

Another mistake to avoid is overlooking future costs associated with owning a sponsor unit. While the initial purchase price may seem affordable, you must consider ongoing expenses like maintenance fees, property taxes, and potential renovations. By planning for these costs ahead of time, you can budget effectively and avoid financial surprises.

Skipping Inspections

Some buyers make the mistake of skipping inspections, assuming that a sponsor unit is in perfect condition. However, even if a unit appears flawless at first glance, hidden issues may exist. Inspections can uncover any potential problems with the unit’s structure, plumbing, or electrical systems, helping you avoid costly repairs later on.

By avoiding these common mistakes and staying informed throughout the buying process, you can make a sound investment in a NYC sponsor unit that aligns with your needs and financial goals.

Summarizing the Journey

Throughout this guide, we’ve delved into the world of sponsor units in New York City. We’ve learned about the different types of sponsor units, including co-op sponsor units and sponsor unit condos. These unique properties offer distinct advantages for buyers looking for a streamlined purchasing process and potential financial benefits.

Benefits of Sponsor Units

When considering sponsor units, it’s essential to remember the advantages they bring. From the possibility of bypassing board approval to having more flexibility in decision-making, sponsor units can offer a convenient and attractive option for buyers.

Key Considerations

While sponsor units present numerous benefits, it’s crucial to weigh the considerations carefully. Factors such as future costs, maintenance fees, and potential renovations should all be taken into account before making a final decision. By being diligent in your research and understanding the implications, you can make a well-informed choice.

In conclusion, sponsor units in NYC open up a unique opportunity for buyers to acquire property without some of the traditional hurdles associated with real estate purchases. By considering the key points outlined in this guide, you can navigate the process of buying a sponsor unit with confidence and clarity.

Frequently Asked Questions (FAQs)

What is a Sponsor Unit?

A sponsor unit is a term used in real estate to describe a unit in a building that is owned by the original developer or sponsor. These units are typically sold without board approval, meaning the buyer does not have to go through the traditional approval process by the co-op or condo board.

Do Sponsor Units Require Board Approval?

Many sponsor units in NYC do not require board approval, which can be a significant advantage for buyers. This means that purchasing a sponsor unit can be a quicker and more straightforward process compared to buying a regular co-op or condo unit where board approval is necessary.

Are Sponsor Units a Good Investment?

Begin your search and start earning cash back!

Investing in sponsor units can have its advantages and disadvantages. While sponsor units can offer the benefit of no board approval and potentially lower costs, there are also risks involved. It’s essential to carefully consider the specific unit, the building, and the sponsor’s reputation before making an investment decision.