Uncover the secrets to securing your dream home in the Big Apple with our step-by-step guide to Rent to Own.

Image courtesy of via DALL-E 3

Table of Contents

Introduction to Renting to Own in NYC

So, you’re thinking about becoming a homeowner in the bustling city of New York? Well, let me tell you about a unique way to make that dream a reality – renting to own. This option is perfect for families like yours who are looking to put down roots in the Big Apple. Let’s dive into what rent to own is all about and why it might be the right choice for you.

When it comes to rent to own homes in New York, it’s all about giving you the opportunity to move into a place of your own. This type of arrangement opens doors for many families in NYC who may not have the resources for a traditional home purchase. With rent to own, you can start by renting a home but have the option to buy it down the line. It’s like testing the waters of homeownership while already having a foot in the door.

Homeownership in NYC can be a daunting prospect, but rent to own offers a viable path to make it happen. By understanding the ins and outs of this process, you can set yourself up for success on your journey to owning a home in the city that never sleeps.

Understanding Rent to Own

When it comes to finding a place to live in New York City, the options can sometimes feel limited. But have you ever heard of something called “rent to own”? This can be a great choice for families who dream of owning their own home in the Big Apple. Let me explain what rent to own is all about.

What is Rent to Own?

Rent to own is a special way of renting a home that gives you the opportunity to eventually buy it. It’s like a mix between renting and buying, offering a unique path to homeownership in NYC. When you rent to own a property, you agree on a rental period during which you can live in the house as a renter. But here’s the exciting part – you also have the option to purchase the home at a later date if you decide you want to make it your own!

Lease Options Explained

Now, let’s talk about lease options. In a rent to own agreement, lease options refer to a contract that allows you to buy the home at a predetermined price after the lease period ends. This means that you have the flexibility to decide whether you want to become the owner of the property once the lease is up. It’s like having the keys to your future in your hands!

Finding Rent to Own Homes in New York

When it comes to finding rent to own homes in New York City, it’s essential to know where to look and what to consider before making a decision. Let me guide you through the process of finding the perfect rent to own property in the Big Apple.

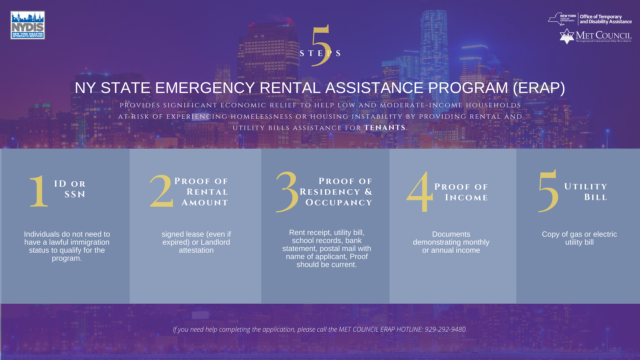

Image courtesy of www.nydis.org via Google Images

Where to Look for Listings

One of the first steps in finding a rent to own home in New York is to explore different listings. Websites like Zillow, Trulia, and RentToOwnLabs can be excellent resources for finding available properties in your desired location. Additionally, working with a real estate agent who specializes in rent to own homes can provide you with access to exclusive listings that may not be widely advertised.

What to Consider When Choosing a Home

When choosing a rent to own home in New York City, there are several important factors to consider. Location plays a significant role in the value and potential resale of the property. Make sure the neighborhood is safe, has access to good schools, and is close to amenities like grocery stores and parks.

Price is another crucial consideration. Ensure that the rent and purchase price fit within your budget and align with the current market value of similar properties in the area. It’s also essential to inspect the condition of the home to identify any potential maintenance or repair issues that may arise during your tenancy.

By taking these factors into account, you can make an informed decision when selecting a rent to own home in New York.

Step 3: Negotiating the Terms of Your Agreement

When you’ve found a rent-to-own home that you love, it’s time to start negotiating the terms of your agreement. This step is crucial in ensuring that both you and the homeowner are on the same page about the lease duration and purchase price. Let me guide you through this process.

Understanding Lease Terms

First things first, it’s essential to understand the lease terms outlined in your rent-to-own agreement. This includes details like the monthly rent amount, the length of the lease period, and any provisions about maintenance responsibilities. Make sure to carefully review these terms and ask questions if anything seems unclear.

Negotiating Purchase Price

One of the most important aspects of a rent-to-own agreement is the option to purchase the home at a predetermined price once the lease period ends. When negotiating the purchase price, consider factors like the current market value of the property, any improvements you’ve made during the lease, and your budget. It’s a good idea to work with a real estate agent or an appraiser to determine a fair purchase price that works for both parties.

| Step | Description |

|---|---|

| 1 | Do your research on the rent-to-own process in NYC. Understand the concept and how it works. |

| 2 | Find a property that offers rent-to-own options. Work with a real estate agent to help you navigate the market. |

| 3 | Negotiate the terms of the rent-to-own agreement with the landlord or property owner. Make sure to clarify all details. |

| 4 | Sign the rent-to-own agreement and pay any required upfront fees or deposits. Make sure to review the contract carefully. |

| 5 | Start making monthly rent payments with a portion going towards the purchase of the property. Stay on top of payments and abide by the terms of the agreement. |

Finalizing the Deal

As you get closer to sealing the deal on your rent to own home in NYC, it’s crucial to pay attention to the legal aspects of the agreement. Make sure all the terms you’ve negotiated are accurately reflected in the contract. This document serves as a legally binding agreement between you and the seller, outlining your rights and responsibilities throughout the lease period and the eventual purchase of the property.

Image courtesy of www.linkedin.com via Google Images

Getting Help from a Professional

While navigating the finalization of your rent to own agreement, don’t hesitate to seek assistance from a real estate professional or a lawyer. These experts can review the contract with you, clarify any confusing terms, and ensure that your best interests are protected. A professional can also help you understand the legal implications of the agreement and provide guidance on any potential pitfalls to look out for.

Preparing for Homeownership

As I think about becoming a homeowner in New York City, I know I need to be smart with my money. I need to start saving up for a down payment – that’s the money you pay upfront when you buy a house. It’s usually a percentage of the home’s total price, and the more you can put down, the less you’ll have to borrow. Saving money might mean cutting back on some things I like to spend money on, like eating out or buying new clothes. But it will be worth it in the end when I can afford my dream home.

Future Planning

It’s important to think about not just buying a home, but also how to take care of it in the future. Owning a home means being responsible for things like maintenance and repairs, which can be costly. I need to start thinking about how I will budget for these expenses and make sure I have a plan in place. It’s also a good idea to think about how long I plan to stay in the home. If I might move in a few years, I need to consider if buying is the best option for me right now. Planning for the future is key to successful homeownership.

Conclusion

As I wrap up our journey through the process of rent to own homes in New York City, it’s important to remember the key steps we’ve covered to help you achieve your dream of homeownership in the Big Apple. Rent to own homes New York offer a unique opportunity for renters to transition into homeowners while navigating the dynamic NYC housing market.

Image courtesy of www.linkedin.com via Google Images

Ensuring a seamless transition from renter to homeowner starts with understanding the rent to own process, including the concept of lease options. Knowing the ins and outs of how rent to own works can empower you to make informed decisions about your future home.

Once you’ve got a grip on the basics, it’s time to find the right rent to own home in New York. Knowing where to look for listings and considering essential factors like location, price, and home condition can help you make the best choice for your needs.

When you’ve found your dream home, the next step is negotiating the terms of your agreement. Understanding lease terms and confidently negotiating the purchase price can ensure that you’re getting a fair deal that works for you.

Before you seal the deal, take the time to finalize all the details, making sure you’ve covered all legal considerations and sought help from professionals to guide you through the process. This will help avoid any surprises down the line.

Lastly, don’t forget to prepare for homeownership. From making financial preparations to long-term planning, taking steps during and after the lease period can set you up for success as a homeowner in the bustling city of New York.

Remember, the road to homeownership through rent to own homes in New York City may have its challenges, but with the right information and approach, it can lead to a fulfilling and rewarding experience. So, take every step carefully, stay informed, and soon enough, you could be unlocking the door to your very own piece of the New York real estate market.

FAQs

Can I rent to own with bad credit?

Yes, you can still pursue a rent-to-own agreement even if you have bad credit. Rent-to-own homes offer a pathway to homeownership for individuals with less-than-perfect credit scores. However, it may be more challenging to find a willing seller, and you may need to negotiate specific terms that work for both parties.

How long does a rent to own agreement usually last?

The duration of a rent-to-own agreement can vary depending on the terms set by the parties involved. Typically, these agreements last anywhere from one to three years. During this time, the renter has the opportunity to improve their financial situation and prepare for ultimately purchasing the home.

Do I need a lawyer for a rent to own agreement?

While it is not legally required to have a lawyer involved in a rent-to-own agreement, it is highly recommended. A legal professional can review the terms of the agreement, ensure everything is in order, and protect your interests throughout the process. Having a lawyer on your side can provide you with peace of mind and ensure a smooth transaction.

Begin your property search now and earn cash back upon closing!

Generated by Texta.ai Blog Automation